Technology

Start Spreading The News: UBS Widens Access To MyWay

The Zurich-based bank, in the process of bedding down its integration of Credit Suisse, is enabling Swiss clients of the latter bank in Switzerland to plug into the MyWay portfolio management platform that UBS rolled out last year. It now boasts $12 billion of AuM.

UBS has made its MyWay

portfolio offering, which it dubs the “Netflix of

banking,” available to Swiss clients using the Credit

Suisse platform. UBS, now owner of Credit Suisse, intends

to extend the offering to Credit Suisse's international clients

later this year.

MyWay’s client assets reached $10 billion earlier in 2024, and

now stand at $12 billion, this news service understands. A total

of 8,000 clients use the channel, about which

this publication wrote here.

The platform is designed for investors who want to determine

how to achieve their goals and set the direction individually

while delegating the day-to-day management to experts. Clients

can invest in a portfolio designed from more than 80

building blocks.

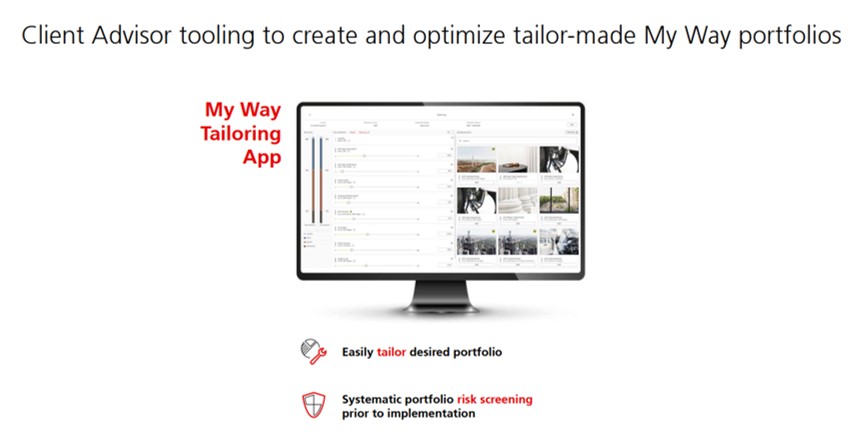

A display of the MyWay front end

“We are delighted to expand our market-leading offering that has

been a great success at UBS to our clients on the CS platform,”

Bruno Marxer, head CIO Global Investment Management, said. “We

continue to see strong traction among clients on UBS MyWay, with

more than 200 new portfolios opened globally on average each

month since the beginning of the year.”

The service allows clients – those with at least $500,000 – to

become involved in constructing their own asset allocations,

leaving the role of picking stocks, bonds and other individual

assets to the bank. This goes a step beyond a conventional

discretionary model because the client, not the firm, directs the

asset allocation that best fits with his or her personal views

and preferences (in line with their overall risk tolerance and

objectives).

This “build-your-own” asset allocation framework has in the past

been more the preserve of clients with tens of millions of

dollars in assets, not those lower down the HNW or even

mass-affluent scale. (This publication wrote about the challenges

of serving mass-affluent clients

here.)

In May last year, UBS expanded its offering to clients across the

UK and Jersey; it is already available in Singapore, and operated

in Switzerland in 2020. It is also available in Hong Kong,

Germany, Italy and Japan.

Affluent clients and robots

UBS has made several forays into tech-driven banking and finance.

For example, in the US, UBS bought $69.7 million note

convertible into Wealthfront shares, giving it exposure to this

robo-advisor business model. It had initially contemplated

buying Wealthfront in an all-cash deal. UBS said this deal

enabled it to accelerate growth in the US and widen its appeal to

affluent investors. At present, UBS’s wealth management business

is largely focused on high net worth and ultra-high net worth

individuals.

The Wealthfront deal was ironic because in 2018 UBS sold its SmartWealth business to US-based online investment advisor SigFig. At the time it appeared that the bank had pulled out of moving into such a channel.