Fund Management

Managers Hone 2021 Investment Opportunities

.png)

January is typically when fund managers post where opportunity is knocking in a year expected to deliver a broad recovery. A round up of views on China, reporting impressive GDP growth this week; the ongoing value versus growth; US equity froth; and where UK blessings can be counted.

GlobalData has revised its global growth forecasts for 2021 raising it to 5.3 per cent on growing evidence of a vaccine-led recovery. Major economies such as the US, the UK and Germany are forecast to grow by 4 per cent, 5.5 per cent and 3.9 per cent, respectively, the group, said. But developing nations face bigger hurdles in "rising income inequality, poverty, and a reduction in remittances from workers abroad," on top of increasing fiscal deficit and gross debt, analyst Bindi Patel said. Here are views from portfolio managers on what is shaping markets around the world this year.

Depressed UK stocks could prove rich pickings In

2021

Scott McKenzie, co-manager of the TB

Saracen UK Alpha Fund, sees value as still very depressed,

with few bigger value discounts than those in the UK market.

"Despite a strong rally from low levels in the final quarter, the

UK market remains a pariah in a global context and continues to

trade on a huge valuation discount. This means there are

potentially rich pickings for UK investors now that Brexit is

done," he said.

Some discounting of UK stocks is warranted as UK indices are dominated by mature sectors such as oil, banks and tobacco and little exposure to technology stocks. The valuation discount permeates across all sectors of the UK, typically leading to lower ratings against global peers in most industries,” McKenzie said.

However, Saracen remains generally positive on the UK market given the potential for positive earnings revisions from their current low levels and improving outlook. "We expect a strong pick-up in M&A activity in 2021 as a result of low valuations in the UK, low interest rates and the wall of money in the private equity world looking for a home."

McKenzie said the firm is beginning to see evidence of a post-COVID-19 recovery in earnings expectations from UK companies. "These have emerged as corporates report strong recoveries from the low points following the initial lockdown, led by pent-up demand in many cases. This combination of low valuation and improved earnings momentum may prove a potent one in the year ahead.”

Are stocks in a bubble?

This was the question raised by Rothschild &

Co in its latest strategy note.

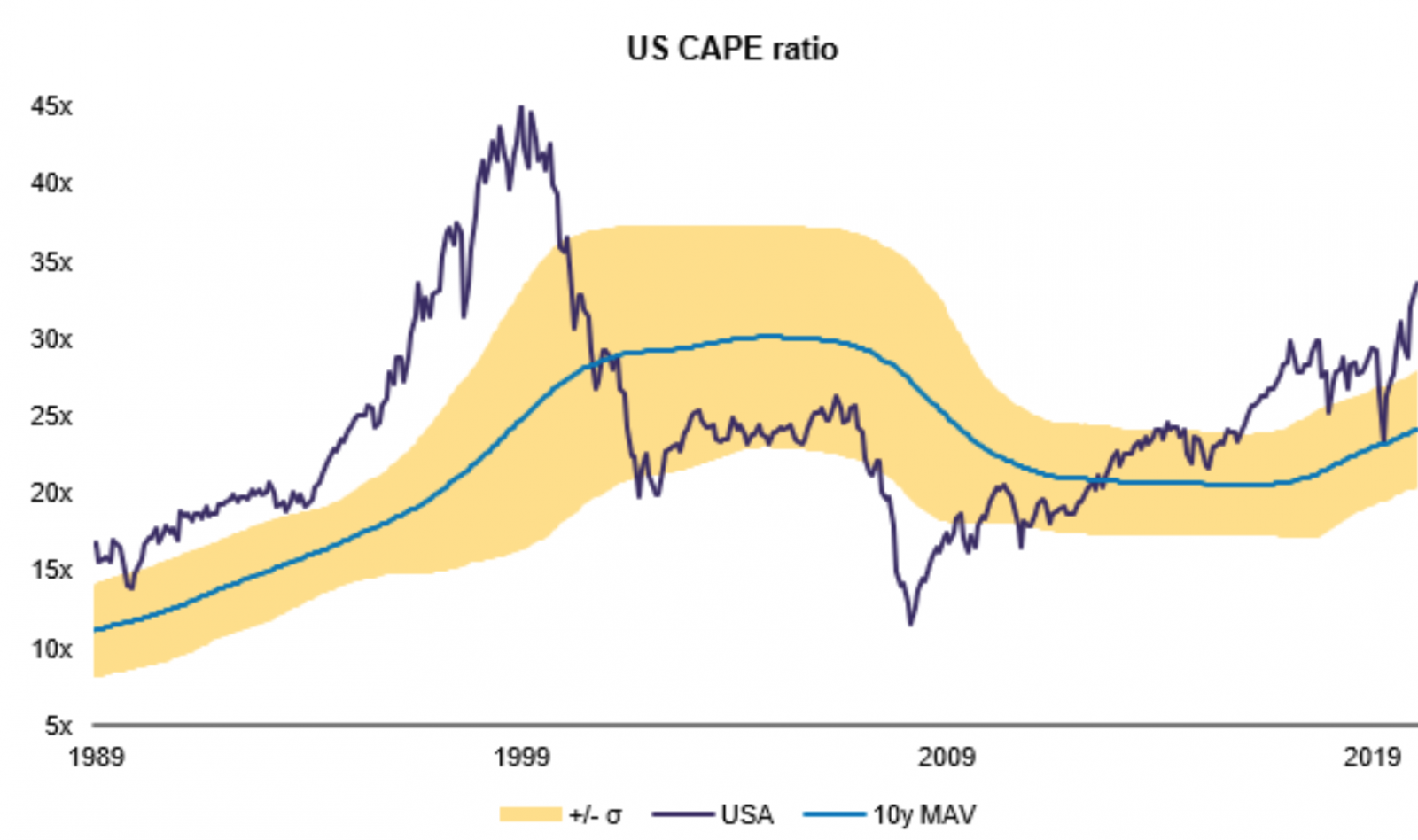

"If we were to view the asset class from a ‘top-down’ approach to investment: we would see them as high, but not outlandishly or prohibitively so. Our preferred metric, a “cyclically adjusted” PE (CAPE) which smooths out short-term fluctuations in earnings by using a ten-year moving average, is shown in the chart (below):

"Looking ahead, the scope for some profit taking in the

short-term must be a near-term risk: a lot of good (or improved)

news is priced-in and cash positions are reportedly at their

lowest level since 2016 (according to the latest Bank of America

Fund Manager Survey – another renowned contrary indicator).

"We are trying to stay open-minded: the last decade has not been kind to more dogmatic pundits. Headroom has likely fallen, but this does not look like a bubble to us (and other markets are of course less expensive than the US). Those prospective long-term ‘top-down’ returns for equities have fallen, but still exceed both likely inflation and the likely returns on bonds and cash."

Alliance Trust stock pickers Bill Kanko and Rajiv Jain expect to see a broader rally in markets, but question whether the surge in some growth stocks – particularly in US mega caps – is sustainable.

“We expect widespread vaccinations in the first half of the year to lead to a recovery in the second half. This post-pandemic recovery should favour a broad rally in stocks, helping to rebalance equity markets that have become heavily biased towards larger companies and momentum stocks such as Tesla, Apple and Microsoft.

Small to mid-cap stocks should also benefit from an economic recovery once the current crisis abates,” the managers said.

Jain, founder of GQG Investments, added that while vaccines are creating a recovery path, we are "questioning the sustainability of some of the recent rally in highly economically sensitive areas given the lack of clarity on vaccine distribution and uptake.

“While we remain cautiously optimistic for 2021, and do believe select cyclical stocks will do quite well, we also believe that certain industries have indeed run too far too fast, as some parts of the market are now trading at levels higher than their pre-COVID levels despite a lack of upward earnings revisions combined with degrees of structural business impairment."

Jain sees bright spots in areas such as healthcare.

“Even though we do not build portfolios by purchasing entire sectors, it is interesting to see, when using the S&P 500 as a proxy, that the healthcare sector is the only sector this year, up to the end of November, to simultaneously see positive forward earning-per-share revisions yet see price-to-earnings multiples fall. If earnings are like gravity, and we continue to believe that they are, then 2021 could be quite robust for these companies.”

China GDP outstripping pre-COVID pace

This week, China reported real GDP growth of 6.5 per cent in Q4

year on, well ahead of consensus estimated of 6.2 per cent. "It

marks a very strong end to the year for Asia’s largest economy,"

Matthew Cady, investment strategist at Brooks Macdonald

said, and why the firm has extended its overweight to Asia

ex-Japan equities.

"China is the only major economy globally to have seen positive real economic growth in 2020, with real GDP growth of 2.3 per cent year-in-year, vs 2.1 per cent expected.

"What’s remarkable is that the speed of this recovery has come against the context of a global pandemic. While China’s GDP will make the headlines today, what’s really encouraging in the breadth of economic strength which supports the overall picture of economic resilience. In China in December, in year-on-year terms, industrial output is up 7.3 per cent, retail sales are up 4.6 per cent, and fixed asset investment is up 2.9 per cent," Cady said.

Are markets too optimistic about the reflation

environment?

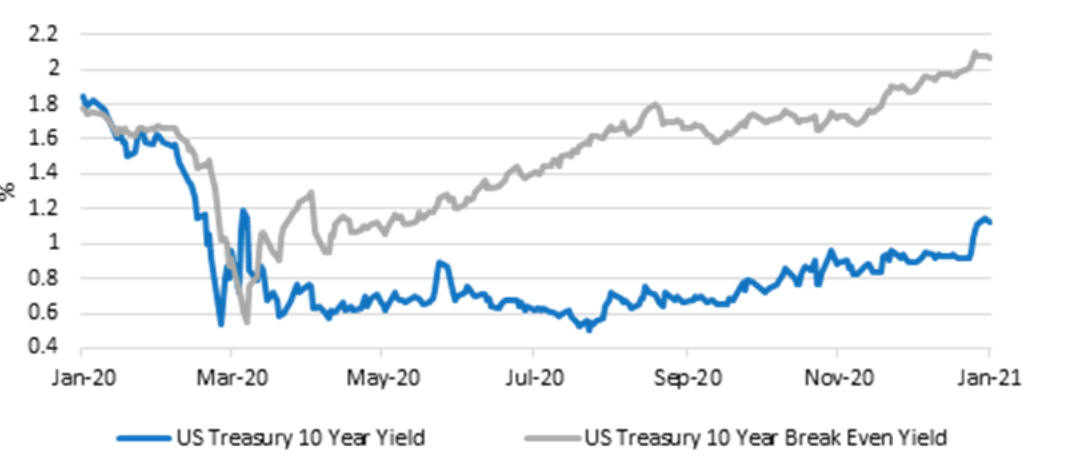

"We have been talking about US Treasuries more than any other

asset class for some time now, as we think it’s central to the

reflation debate and to the behaviour of investments across the

asset class spectrum," remarked Anthony Rayner, fund manager at

Premier Miton

Investors. The chart below shows the US Treasury 10-year

yield breaking through the psychologically important 1 per cent

mark (blue line below), and equally important perhaps, the US

Treasury 10-year break even yield, which measure the market’s

expectation of inflation, moved to a two-year high (grey line).

"Inflation expectations have indeed increased swiftly but it

would be wrong to say that they have moved to excessive levels,"

Raynor said. Either way, currently, markets are taking a very

positive view of things.

"The market consensus is very positive, with risk-on the dominant narrative. With that, there does seem to be a sense that we have moved on from an “everything” rally. We include ourselves in that group that think bonds might struggle this year, particularly developed government bonds, while other safe havens such as gold might do less well if real yields rise. There is then a healthy side to this, in that diversification could increase in markets, allowing portfolios to be more balanced. Nevertheless, at some point, the debate will likely move on to whether looser fiscal policy leads to tighter monetary policy."