Technology

Kingswood Partners With Moneyinfo Over Client App

The new technology, which highlights the firm’s tech roadmap redesign, was developed following feedback from older and younger generations clients.

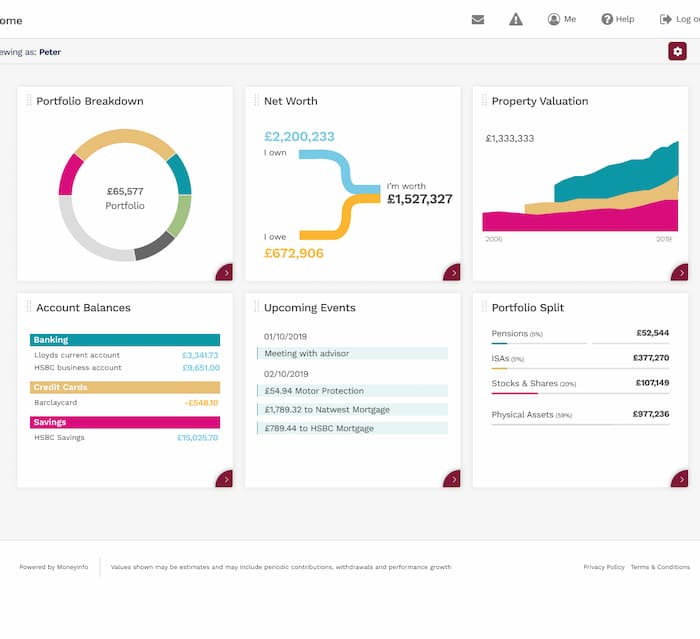

London-listed wealth management house Kingswood has launched a new

online portal for clients, developed in partnership with

technology designed by wealthtech firm moneyinfo.

Providing a single client view, Kingswood Go will be available

via desktop and a mobile app. The app will allow clients to

access and track their investments, and hold other financial

products including insurance products, property, bank accounts

and other assets. Clients will be able to communicate securely

with their advisor via encrypted WhatsApp-style

messaging.

Documents can be shared, signed digitally and then encrypted in

the cloud, eliminating the need for paper documentation and

visits to the advisor’s office. The portal also includes a folder

for emergency access to paperwork and insurances.

In a statement, Kingswood said that the new technology increases

client loyalty, improves workflow and streamlines core business

processes.

“We are delighted to launch Kingswood Go, a product generated

from comprehensive feedback gathered from our clients, who are

now busier than ever and eager to have easy access to their

accounts online and benefit from highly tailored communications

with their advisor. We are proud to have built this new offering

made available both via desktop and mobile app in response to

requests from both the older and younger generations,” Lucy

Whitehead, chief client officer at Kingswood, said.

“Our reliance on technology has only deepened over the past

couple of years and we expect this trend to continue,” Harriet

Griffin, chief operating officer at Kingswood, said.

“Kingswood is a forward-thinking, fast growing and highly

acquisitive wealth management firm with an appetite to move with

the times. We are very happy to partner with them to deliver a

tailored digital client experience via the Kingswood Go branded

app which will ensure that as they grow and acquire new clients,

they can continue to deliver the same great level of tailored

client service that the firm is known for,” Sim Sangha, business

development director at moneyinfo, said.

Kingswood, which has grown in recent years, now has £9.1 billion

of assets under advice and management and more than 19,300

clients, it said in a statement.

The firm has

made four acquisitions in the UK this year, including

Allotts Financial Services; D. J. Cooke (Life & Pensions);

Joseph R Lamb Independent Financial Advisers Ltd; and Aim

Independent. Late last year, it also acquired Metnor, the holding

company for IBOSS Asset Management and Novus Financial Services.