Investment Strategies

Japanese Equities Deserve Fresh Look

The Asia-focused asset management firm talks about the case for investors taking a new look at Japan - a market that it says is attractively valued, given current trends.

The Japanese equity market is worth examining for its valuations,

according to Shuntaro Takeuchi, portfolio manager, at Matthews

Asia, the US-based asset management business focused on Asia.

Why are Japanese equity valuations significantly lower

than those for US equities?

For the past 25 years, Japan has traded at a discount versus the

US, both in terms of price-to-earnings and price-to-book. In the

first 15 years of this period, the discount was justified given

Japan’s poor return on equity (ROE) and return on invested

capital (ROIC). For the past decade, however, the market hasn’t

been pricing in the positive changes achieved by Japanese

companies. ROE and ROIC of Japanese companies are now within a

few points of other markets and, if you look at median ROIC,

Japan was higher than the US and Europe between 2016 and 2018.

Although Japan’s profit profile is improving, we have yet to see

a multiple expansion. In fact, multiples have shrunk in certain

instances - and that’s where we see opportunities.

What are some secular growth drivers in Japan that might

be underrepresented in the benchmark MSCI Japan

Index?

Many index-based investors are missing opportunities in small

caps. Japan offers a unique opportunity for investors to access

growth at a very early stage, given that there are about 70-90

Japanese IPOs each year.

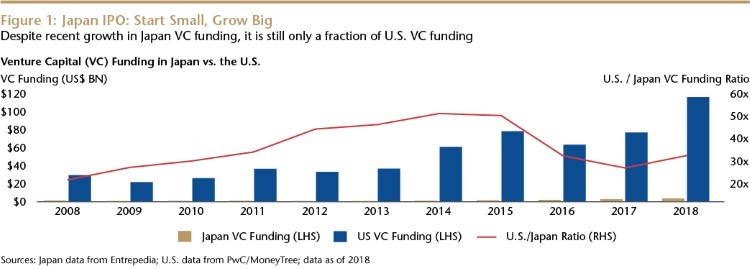

A few factors are behind this environment. Venture capital (VC)

funding in Japan totalled $2.5 billion in 2018, approximately

one-thirtieth of the US total. For additional context, VC funding

in China surpassed $100 billion in 2018. Compared with the US and

China, Japanese start-ups are practically forced to go public at

a very early stage. IPOs in Japan are often comparable to series

B or series C funding in the US.

Additionally, the absence of mega-cap high-growth companies in

Japan structurally supports Japanese small-cap companies, which

could copy what successful start-ups are doing. To the contrary,

many of the larger companies in Japan are in legacy,

slower-growth areas, and it is the smaller growth companies that

take market share from the larger players.

What opportunities can investors find in Japan that

aren’t available in the US, Europe or emerging

markets?

First, compared with Europe and emerging markets, Japan is geared

towards technology, industrials, and, to a certain extent,

healthcare. It has a lower exposure to interest-rate sensitive

sectors, such as financials, energy and materials. As a result,

investing in Japan is essentially participating in the innovation

areas of economic activity, not the fluctuation of interest

rates.

Second, Japanese small-cap stocks are liquid compared with other

international markets. For example, Japan’s small caps trade more

than many of the emerging market countries as a whole, and trade

more than all frontier markets combined. Furthermore, Japanese

small caps as an asset class have a low correlation to the

S&P 500 Index.

Third, Japan’s benchmark index, the MSCI Japan Index, has a lower

concentration than benchmarks for other international regions,

which creates opportunities for active investors.

What can other countries learn from Japan’s experience

with an ageing population? And what investment opportunities does

it create?

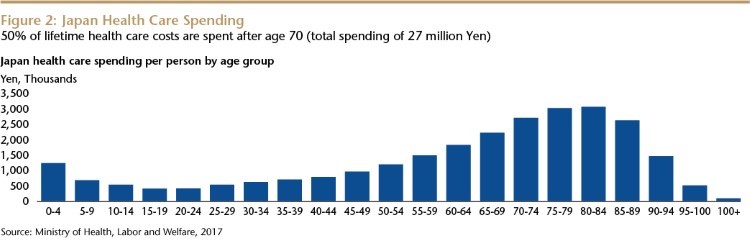

Japan has experienced an ageing society earlier than many other

countries and 50 per cent of lifetime healthcare costs are being

spent after age 70. With Baby Boomers now reaching this age, we

think companies that tackle the issue of rising healthcare costs

is a growth area and potential investment opportunity. These

opportunities range from pharmaceuticals that cure or prevent

diseases, to medical devices or equipment for minimally invasive

surgeries that enable patients to have shorter hospital stays. It

also covers healthcare platforms that rationalise the marketing

costs of pharmaceutical companies.

I

Japan is also dealing with a decline in labour population, which

creates a need for improved labour productivity - especially in

white collar jobs. This is an area in which many software and IT

service companies are operating, working to improve labour

productivity and drive profit growth.

With a new prime minister in Japan, what’s on the horizon

from a government policy perspective that might promote economic

growth?

We see several positive developments, including Prime Minister

Suga’s willingness to expand fiscal stimulus to offset the

negative consequences of COVID-19 and boost domestic consumption.

Another positive we’ve seen from the government is its policy flexibility.

The Bank of Japan (BOJ) bought ETFs to provide market liquidity

and has the option to buy more. How do you think the BOJ will

manage its large ETF portfolio when it comes time to slow down

its purchases or wind down its holdings?

When the BOJ said it would double ETF purchases, a key part of

the messaging pertained to its option to do so; it did not make

an outright commitment to double the amount. Going forward, we

think that the BOJ can essentially carry out stealth tapering. As

long as fundamentals remain sound and the market reflects the

earnings potential of Japanese corporate profits, the BOJ can

preserve its option to buy ETFs but reduce its pace of purchases.

This would happen before outright selling.

How much would a resurgence in global trade benefit

Japan? And how much of that benefit is driven by export-related

earnings and profits?

From a cyclical perspective, about 60 per cent of Japanese

corporate profits come from the export sector. It is a

beneficiary when global trade bottoms out and starts to improve.

That’s one of the reasons why Japanese equity markets have

performed well year-to-date.

Structurally, growth in Japan is driven by both the export sector

and the domestic sector. Over the past decade, there has been a

10 percentage-point decline in share of profits from the export

sector, which has mainly been achieved by profit growth in the

domestic services sector. In terms of investments, the Japanese

domestic market is still the third-largest market in the

world.

What is the case for investing in growth companies in

Japan today?

Now is a good time to own Japanese growth equities, in our view.

Japan’s market is a beneficiary of the bottoming out of global

trade and subsequent improvements. Furthermore, a constant

decline of interest rates generally favours growth stocks due to

increased profits and multiple expansion. As global investors

look for strong growth profiles at attractive multiples, the

Japanese market comes into play: Japanese companies are seeing

profit growth but haven’t yet seen multiple expansion.