Investment Strategies

Inverting Bond Yield Curve Doesn’t Imply Recession – Morgan Stanley

The US bank and wealth management firm examines whether a change in the shape of US government bond yield curves is a red flag for recession, or whether it is a matter that should not unduly worry investors.

An inverted shape of the US government bond yield curve, caused

by how yields on short-dated Treasuries are above those with

longer maturities, doesn’t necessarily imply that a recession is

on the cards, because forces currently in play are unique,

Morgan

Stanley says in a note.

The huge economic disruptions and costs caused by COVID-19

lockdowns, spiking energy costs and rising inflation have been

accompanied by rate hikes from the US Federal Reserve, moving the

Fed funds rate from zero to a corridor of 0.25 per cent to 0.5

per cent. More rate rises are expected. Inflation has spooked

markets. In February, the consumer price index rose 7.9 per cent

from a year ago, the highest rate in four decades.

Banks and wealth managers are trying to work out how to position

clients' portfolios at a time when rising inflation and the

prospect of rising rates is forcing them to re-think asset

allocations. The past decade has seen a flood of money into

relatively illiquid segments such as private equity and credit

amid a drop in yields on conventional government debt and listed

equities.

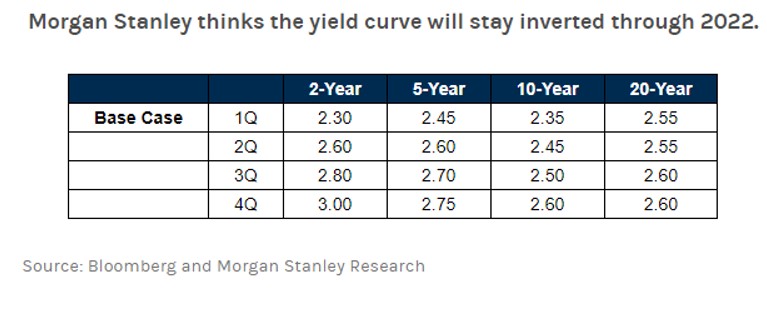

Recently, yields for two-year Treasuries moved higher than those

of 10-year Treasuries, or what economists call a “2s10s” curve

inversion. Morgan Stanley strategists said they think the

2s10s curve will invert further and sustain that inversion

throughout the remainder of the year. (See chart.)

“Historically, this has signalled an imminent recession. This

time around, however, the inversion has more do with near-zero

interest rates and strong demand for long-term Treasuries than

the health of the economy,” the firm said in a note.

“Overall, the yield curve has become less of a recession

indicator over the last two economic cycles,” Morgan Stanley’s US

chief economist Ellen Zentner said. “And when we look at factors

in the economy that are typically signals of a recession, such as

job growth, retail sales, real disposable income and industrial

production, we don’t see an approaching recession.”

All things being equal, bonds with longer maturities typically

need to pay higher interest rates to compensate investors for the

additional risks that come with owning these fixed-income assets

over time, the bank said. When a yield curve is “normal”, it

slopes upward; the longer a bond’s maturity, the higher its

yield. In the past, an inversion has flagged that investors

collectively see more risk in the immediate future than down the

road.

But the bank said the past two economic cycles haven’t been

typical. “In reality, yield curves flatten for a multitude of

reasons, most of which aren't a reflection of investor views

about slowing growth,” Matthew Hornbach, global head of macro

strategy for Morgan Stanley, said.

The bank said rate rises usually nudge interest rates for other

bonds higher, but the effect isn’t always linear and at present

short-term bond yields are increasing while yields for

longer-term bonds have barely budged. This is because there is

strong global demand for US Treasuries, as well as the US

government’s own bond buying.

“Higher rates don’t always mean recession. The Fed is raising

interest rates to combat inflation and keep the economy from

overheating. While markets often have a knee-jerk reaction to

higher interest rates, many times the Fed has raised rates

without triggering a recession,” the firm said.

Morgan Stanley also argued that banks won’t stop lending,

contrary to what some market watchers may fear. The bank said its

research shows that bank loans grew during the prior 11 periods

of yield curve inversion since 1969. And this year, they project

loans will grow 7 per cent year-over-year.

“In the absence of growth headwinds from geopolitical events,

curve inversion alone would not be a cause of concern for

corporate credit, given healthy balance sheet fundamentals,”

Hornbach said.