Investment Strategies

How The Pandemic Kick-started The Japanese Digital Revolution

.jpg)

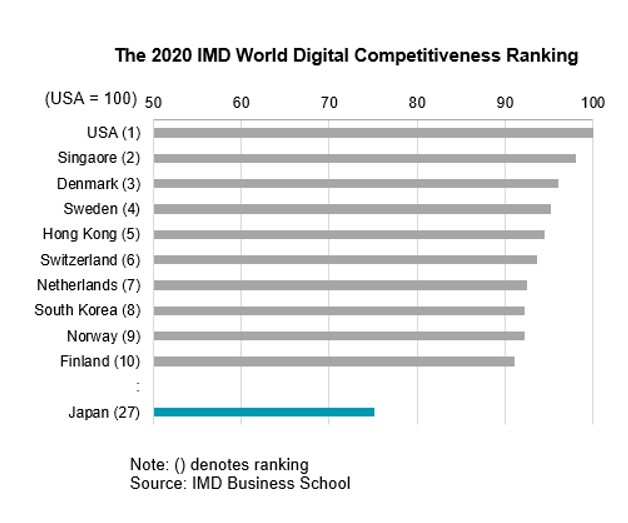

In general terms, the pandemic accelerated the digitalisation of Japanese industries, although the country lags some peers in boosting efficiency with IT. Potential is high, which is why investors should take a look, the author of this guest article says.

As with other economies, Japan has also been affected by the COVID-19 pandemic. A common factor is that lockdowns and other restrictions have acted as a catalyst for rapid technological change accelerating the use of digital tools – a trend which had been gaining ground even before the crisis. Wealth managers have also been caught up in this process.

Japan is famously a home to robotics and, in some respects, is a global leader in related fields. How has the pandemic affected this sector and what are the implications for investments? To consider these questions is Mr Hiroyasu Sato, portfolio manager of the Japan Growth Opportunities Strategy, SuMi TRUST. The editors are pleased to share these views. The customary editorial disclaimers apply. Email tom.burroughes@wealthbriefing.com

In the wake of COVID-19, Japan’s overdue digital revolution might

just be about to take off. One of the big legacies of the

pandemic for Japan will be the way it has changed attitudes about

digitalisation and the modernisation of legacy IT systems.

Shockingly, for a country that was perceived abroad as

technologically cutting edge before the virus struck,

Japan’s digital infrastructure may have been as much as 20 years

behind that of the US, the UK and parts of Europe, with most

government communications still being carried out by fax.

Private industry was no better.

A number of Japan’s failings during the pandemic were directly

linked to inadequate IT infrastructure, online booking systems

and poor management of online data. In the wake of COVID-19,

companies and government departments realise that urgent reform

is needed. Japan has advanced hardware in many of its industries

but companies often lack the right mindset to maximise

efficiencies from software.

The Kishida administration, which is following in the footsteps

of the previous government of PM Sugaand, has made it a big

priority to change this. PM Kishida launched its digital agency

in 2021, a government taskforce with a mission to centralise

government data, oversee digitisation of documents, overhaul old

regulations that mandate a paper trail and encourage businesses,

large and small, to take digitalisation seriously. This big push

for digitalisation in Japan provides strong opportunities for

investors, but there are also potential risks.

Opportunities

Should the digitalisation drive succeed, the gains could be

enormous. Opportunities for investors come through companies

which are set to increase productivity and revenue by introducing

overdue digital reforms, as well as those businesses which

also provide their own IT systems and software. Sectors

where a lot of digital progress could be made include healthcare,

where nurses’ reports are still handwritten, real estate, where

regulations still tend to assume that all transactions are

face-to-face, and the education sector, where paperwork is

abundant.

Three companies which are well placed to exploit this trend are

SRE Holdings, Infomart and Money forward. SRE Holdings is a

“property tech” company providing digital and AI solutions to the

real estate market, particularly to brokerages, which in Japan

tend to be small companies operating in a fairly old fashioned

way. Currently a number of regulations in the real estate sector

in the country prevent modernisation through digital solutions

and AI. The Kishida administration is liable to roll these back

and SRE is extremely well placed to take advantage of this when

it happens.

Informart is in the restaurant business and specialises in

digitalising the purchasing process for restaurants. In Japan

many restaurants are small and run by individuals or small

families with paper or fax being the main means of communication

with suppliers, banks and government agencies. Informart is

pioneering an industry-wide digital slip to allow restaurants to

handle purchases and payments more efficiently, provide and

receive allergy information and contribute to COVID-19 track and

tracing measures.

Money Forward specialises in cloud-based accounting software for

individuals and SME owners. Traditionally Japanese SMEs made

little effort to digitalise accounting procedures, a factor which

contributes to low productivity. As the pandemic struck, moving

these functions online became a necessity because employees could

not always be in the office to carry them out in the old manner.

Money Forward seized the business opportunity and now has over

180,000 clients. It has also expanded its business areas from

accounting and finance to human resources through to M&A

activities. The company has long-term growth potential.

As well as thinking about companies well placed to benefit from

Japan’s shift to digitalisation, investors can also have some

confidence that the gains will have a broad impact across listed

Japanese companies and the Japanese economy: better and more

extensive use of IT is set to lead to real productivity

gains.

Japan’s conversion to digitalisation is part of a bigger trend of

cultural change for Japanese companies. Increasingly we are

seeing companies introduce a more flexible personnel system in

which a company focuses on results rather than age and seniority.

Business are also showing greater willingness to think

holistically and introduce company-wide procedures and systems

whereas traditionally Japanese management has been quite bottom

up.

Risks

However, it is not all smooth sailing. The biggest risk for

investors is that the government’s digital agency fails in its

mission. It has a big task ahead of it. Japan’s opposition to

digitalisation is rooted in the management structure of Japanese

companies. Essentially large-scale digitalisation, which often

comes about in a top-down way elsewhere, isn’t pushed by senior

management in Japan, which tends to avoid large-scale changes

without very active consent from middle management.

A second issue investors need to be aware of is the possibility

of domestic Japanese digital service providers being pushed out

by foreign competition. American and European software and

digital system providers have a head start over their Japanese

equivalents, because digitalisation is already more widespread in

their countries, potentially giving them advantages of scale and

experience in some cases. This is more of a concern if the

software and digital service providers are working for large

Japanese companies, the mid-sized and small Japanese companies

are more likely to adhere to domestic suppliers.

Overall COVID-19 has acted as a catalyst in the digitalisation of

Japan. The country may still be behind its peers among the

developed nations when it comes to boosting efficiency through

the use of IT and software but big changes are now imminent.

Although there are uncertainties, now is a good time to take a

closer look at the Japanese digital and software space to take

advantage of the opportunities there.