Family Office

How COVID-19 Affects Single Family OfficesÂ

This article examines how the virus has affected the principal, or "cornerstone", assets of prominent European families, and considers what happens next. This is part of our series examining family office issues.

As part of our

series on family offices, we look at what are called

“cornerstone” assets, the company that gave rise to the wealth

behind a family. Here we present data thanks to the analytics and

research firm Highworth, this news

service's exclusive media partner. (Click

on this link to register for the Highworth database.)

Inevitably, the crisis caused by COVID-19 must be considered and

here, Highworth’s founder and managing director Alastair Graham,

considers how this virus has hit “cornerstone” assets for single

family offices.

Many single family offices hold a cornerstone asset which is

often a majority-owned or a significant minority-owned company

from which the family originally gained its wealth. With most of

the largest family offices, the cornerstone asset is usually a

listed company. A comparison of the value of the cornerstone

asset of 10 single family offices with assets under management

greater than €1 billion ($1.1 billion) using data from the

Single Family Offices Database from Highworth Research and

WealthBriefing, reveals the extent to which COVID-19 has

hit some of the largest private capital owners in Europe.

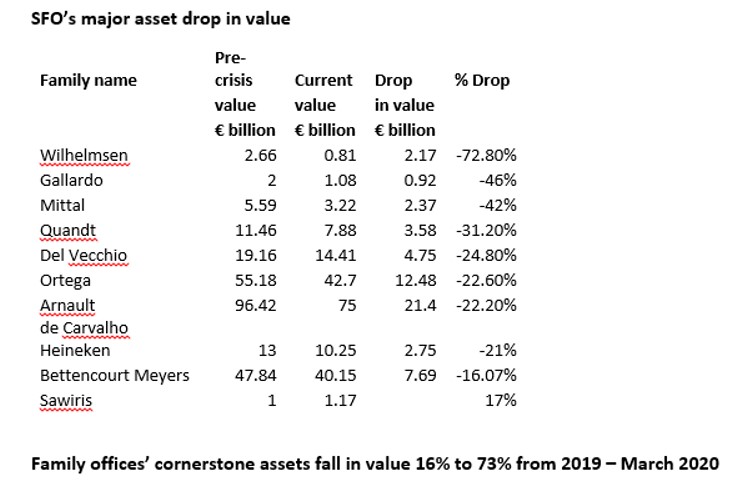

The table below shows the following:

- The families behind 10 of the largest single

family offices in Europe;

- The value of their stake in a listed company,

being their cornerstone asset in their portfolio, at a variety of

dates in the past 12 months, where the specific dates are not

important but the material point is that the values were taken

pre-COVID-19;

- The value of the cornerstone asset on 13

March 2020, following the initial effect on stock-markets of

COVID-19; and

- The drop in value of the cornerstone asset

both in euros and percentage terms.

The worst hit, with a fall in value of 72.8 per cent, is the

Wilhelmsen family of Norway whose family office, Aweco Invest,

includes an asset whose growth has dramatically gone into

reverse:

Royal Caribbean Cruise Lines. The family holds 12 per cent of RCL

– but used to hold 20 per cent, a holding which only two years

ago in March 2018 was valued at $3.67 billion. Fortunately, 8 per

cent was divested pre-2020 when the stock price was

strong.

The Gallardo family of Spain, majority owners of the country’s

largest pharmaceutical company Almiral, has suffered a 46 per

cent fall in the value of their major asset, while the Mittal

family of the UK, whose family office is LK Advisors, has seen a

fall of 42 per cent.

Less badly hit is Stefan Quandt, whose family office, Aqton,

holds 25.6 per cent of BMW, and Leonardo del Vecchio, whose

family office Delfin, holds 32.7 per cent per cent of

EssilorLuxottica.

Bernard Arnault’s holding in LVMH through his family office

Groupe Arnault, is down in value by €21.4 billion, with the China

market for luxury goods badly hit. Amancio Ortega’s family holds

64.34 per cent of Inditex, parent company of the Zara retail

chain among others, the value of which has fallen by €12.48

billion. Last week Zara’s parent Inditex announced that it was

temporarily closing all its stores in Spain as part of the

country’s “social distancing” policy.

Least badly affected are families whose cornerstone assets relate

to beer, and cosmetics. Charlene de Carvalho Heineken’s family

office, L’Arche Holding, has seen the value of its stake in

Heineken NV fall by a less precipitous 21 per cent. The

Bettencourt Meyers family, together with their family office

Téthys, hold 33.3 per cent of l’Oréal, and have seen their

cornerstone asset fall by 16 per cent.

Where is the good news?

Amidst the gloom, there are five significant pieces of good news

for European single family offices.

First, the nine billionaire families and their family offices

mentioned above as high profile financial casualties of the onset

of COVID-19, nonetheless, mostly hold within their family offices

a diversified spread of assets and are not overly dependent on

their cornerstone asset.

Second, the cornerstone asset is still worth multiple billions in

8 of the 9 cases mentioned.

Third, the chief investment officers at the nine family offices

will be keen to diversify their spread of asset classes yet

further when normal markets resume.

Fourth, the tenth family on the list above, that of Naguib

Sawiris whose family office is Orascom TMT Investments in

Luxembourg, beat the precipitous market downturn. He did this by

gradually buying up gold mines starting in 2012, such that by

2019 the value of these assets had reached $1bn. From April 2019

to March 2020 the price of gold has climbed by 17 per

cent.

In an interview he gave to CNBC in 2018, Sawiris said he regarded

gold as an appropriate asset to hold “when there are crises

around” or “for someone who wants to have a balanced

portfolio.”

Fifth, and everyone would hope, showing even more foresight than

Naguib Sawiris, is the example of Dieter Hopp, a co-founder of

SAP, the software multinational. Dieter Hopp still retains a 5.04

per cent stake in SAP, valued at €5.99 billion on 13 March 2020,

and that is his major financial asset.

However, in 2010 his family investment company, dievini Hopp

BioTech Holding, participated in a venture round to raise €27.6

million for a company called CureVac, based in TĂĽbingen, Germany.

In 2012 dievini Hopp further participated in a Series D round

which raised €80m, and a Series F round in 2015 which raised

€98.5 million for the biotech company. Dievini Hopp now owns 80

per cent of CureVac AG. The firm is believed not yet to be

profit-making after 10 years. But like many single family office

investors in VC, Dietmar Hopp believes in “patient

capital”.

CureVac may possibly be worth the wait. The firm is a

clinical-stage biopharmaceutical company which develops

mRNA-based drugs for vaccines, and is believed to be among the

leading contenders to develop a vaccine for COVID-19.

Source for data in this article: Highworth-WealthBriefing

Single Family Offices Database.