Investment Strategies

How Are "Green Bonds" Coping With COVID-19 Turmoil?

An investment firm takes a look at how the market for green bonds is faring in the current extremely challenging environment.

The market for “Green” bonds, a market tapping into funding

of zero- or low-carbon energy projects and ventures designed to

protect the environment, has grown rapidly. The global pandemic

poses a big challenge to whether investors can stay the course

through this crisis.

Infrastructure around such debt instruments has flourished in

recent years. A new set of principles emerged in 2018 under which

the Loan Market Association (the leading professional association

of banks) released the green loan principles. These principles

aim at creating a framework for the green loan market. They were

followed in March 2019 by the sustainability loan standards.

Here are recent comments about a green bond market that now is

about a decade old. The comments come from says Bram Bos, lead

portfolio manager for Green Bonds at NN Investment

Partners. (Seperately, this publication has been examining

continued trends in the ESG space; see here for a brief

overview.)

“In the current market environment, when traditional bonds sell

off, green bonds sell off too. That is a fact”, Bos said. “In the

last few weeks, there has not be a significant difference in how

green bonds have behaved in comparison to their traditional

peers.”

In markets like these, prices are not necessarily a reliable

measure of underlying sentiment, he reckons. According to Bos,

flows are more important; most green bond portfolios and managers

are holding on to the bonds in their portfolios.

Looking at traditional corporates versus corporate green bonds,

the performance of the corporates index has been slightly better.

“Its composition offers a possible explanation to this,” Bos

said. “The green bond corporate index does not include airlines

or energy companies – those sectors were hit by the compounded

effects of the coronavirus and the plummeting oil price. However,

it does, for example, include utility companies that have

well-regulated businesses. These tend to be better prepared for

uncertain times, are more forward looking and are often better

managed than firms that do not issue green bonds,” he

continued.

Cyclical sectors appear to be suffering in the current

environment, irrespective of whether they have issued green debt

or not. But the longer-term trend is more important. In the case

of the automobile industry, for example, the trend away from

fossil fuel and towards renewable energy is not going to change

because of this crisis. NN IP said it thinks those companies that

are investing in making this transition, will have the best

chance of survival in the long run. Although investors may

temporarily lose sight of these aspects in the day-to-day

volatility of short-term market movements, these companies are

well-prepared, it said.

“In our experience, companies that issue green bonds are more

forward-looking, more innovative and more flexible,” Bos

said.

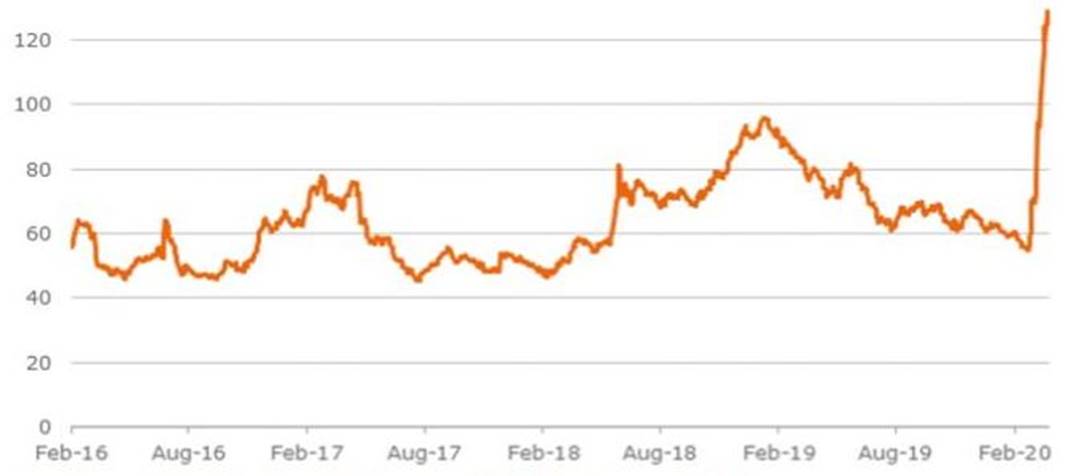

Spread Bloomberg Barclays MSCI Euro Green Bond Index (bps)

Source: Refinitiv Datastream, NN Investment Partners

The current volatile environment does not seem to be impacting

the trend towards sustainable finance – allocations to green

bonds are not being affected at all. “Although it’s still early

days to draw any major conclusions”, Bos said, “we don’t see

interest in green bonds diminishing in terms of our clients, nor

are our funds experiencing much outflow. In general, investors

seem to be pushing ahead with their plans to make new allocations

to green bonds.”

Looking ahead, there are some positives that could come out of

this situation, but a lot will depend on how long this crisis

lasts. Markets could fall further and we could see more defaults

before things get better, NN Investment Partners said.

“I think many companies will start to appreciate the qualities of

green bonds as a funding tool. The traditional capital markets

are suffering in these uncertain times and although green bonds

fall too, the underlying demand is intact. It is all about being

prepared and making your business future-proof. The next crisis

could be a climate crisis. The current situation is triggering

companies to look ahead.

Governments are also going to have to spend more. In particular,

I believe their green expenditure will increase. They also want

to make their economies more resilient. So yes, I'm very

convinced there will only be more demand. We should see a

continuation of the growth of the last two years and the effects

of the crisis may even give the green bond market an additional

boost,” he said.

NN IP expects the sovereign green bond segment to also benefit

from the unprecedented fiscal and monetary policy response. This

segment currently makes up about 17 per cent of the total green

bond market, with fewer than ten issuers so far. Even prior to

the coronavirus crisis, this was set to change with a number of

new potential European sovereign candidates for 2020, including

Germany, Italy, Spain, Sweden and Denmark.