Offshore

Hong Kong Tops Corporate Services IFC Rankings - Vistra Survey

The pressure for more transparency in jurisdictions and issues such as Brexit struggles in the UK affected rankings in the latest study.

Hong Kong has leapfrogged the UK and the British Virgin Islands as being the best jurisdiction in which to do business, with Brexit uncertainties and worries about European Union pressure on offshore centers playing a part, a survey shows.

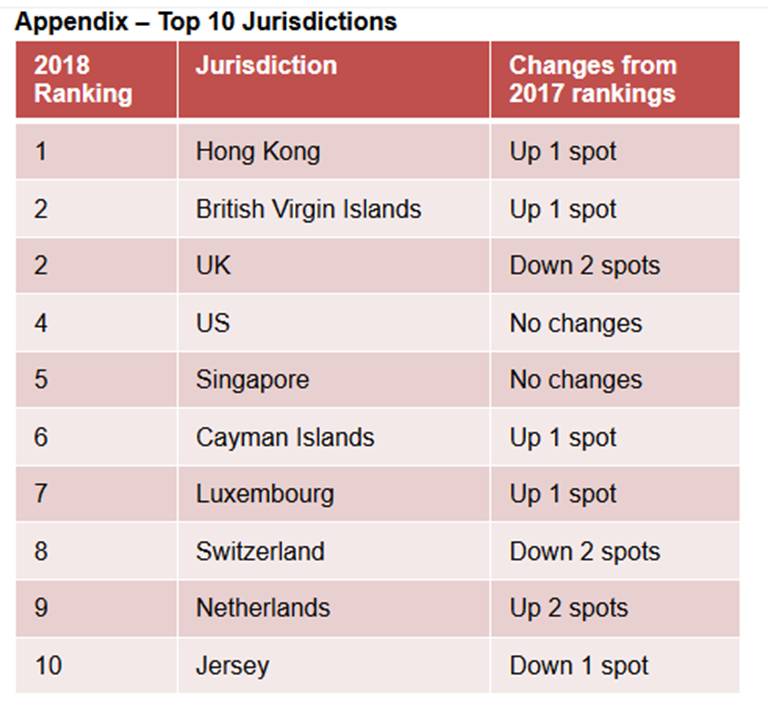

Vistra, the trust, fund administration and corporate services provider, polled 800 industry professionals in the corporate services space to ask about the places they favored the most. Hong Kong comes top, with the BVI and UK in second and third place, respectively. The US and Singapore ranked fourth and fifth, respectively.

“Globally there has been an increase in demand for transparency due to the negative publicity towards offshore centres; evidenced by the changing regulatory landscape to meet these demands. As such, it is timely to review whether offshore jurisdictions might fall out of favor; and the research shows that there has been limited change in the popularity of jurisdictions compared to the last report released a year ago with the top five comprising the same jurisdictions,” the report said.

“At the time of our research, we found there is a continuing trend towards onshore and mid-shore jurisdictions, with the top five dominated by international financial centers either in or close to the world’s political centres,” Jonathon Clifton, regional managing director, Asia & Middle East, Vistra, said. “This also confirms our overall research findings that despite the uncertainties of globalization, the industry continues to be optimistic towards driving economic growth.”

“With that said, we have recently witnessed a decline in demand

for certain offshore jurisdictions such as the BVI and Cayman

Islands due to uncertainty driven by the European Union’s recent

‘economic substance’ requirement. We will need to keep a close

watch on how these jurisdictions fare in the future in light of

new regulations coming into play,” he added. (Clifton referred to

how offshore centers are pushing through “substance” legislation

to avoid being placed on the EU’s blacklist of jurisdictions it

deems not to be sufficiently open and co-operative over issues

such as tax.) The BVI has reportedly warned that the substance

legislation will lead to a 10 to 20 per cent cut in financial

services business.

Top three

Hong Kong

The rise in Chinese companies listing on the Hong Kong Stock

Exchange and a growing base of Chinese high net worth individuals

with increasingly sophisticated needs have largely contributed to

the city’s leading position, Vistra said.

“Hong Kong appears to be an attractive platform thanks to its lower tax rate and a stable legal system. Despite 33 per cent of respondents believe that political upheaval has affected Hong Kong’s reputation as an IFC, any harm has been offset by the city’s winning business from offshore regions, particularly among clients in Asia,” it said.

BVI

“Following the Panama Papers in 2016 and the Paradise Papers in

2017, it would be easy to expect the jurisdiction to fall in the

rankings. Yet the BVI remains at number two and has experienced

growth in new incorporation volumes: 11.2 per cent in the first

nine months of 2018 over the previous year, in Vistra’s

portfolio, much of it reliant on Chinese investment. Indeed,

where the BVI is seen as challenged, this has primarily been due

to perception rather than the quality or prospects of the

jurisdiction,” it said.

UK

“In prior years, Brexit was not an issue and the UK’s favourable

corporate tax rate and flexible labor legislation provided a

friendly environment as an IFC. Today, respondents take a dimmer

view of Brexit’s implications with only 35 per cent expecting the

UK to become more open to the industry and IFCs after Brexit. If

the country cannot provide attractive conditions for business, it

is expected that a greater number of organizations will switch to

Luxembourg or Frankfurt as their European headquarters,” Vistra

added.

Table