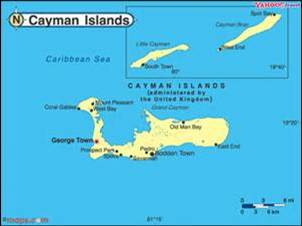

Offshore

Groups Applaud Cayman Islands' EU Blacklist Exit; Oman Also Removed

While the existence of such blacklists can be politically controversial, the removal of the Cayman Islands will nevertheless be welcome for that Caribbean jurisdiction's financial industry. Oman has also been scrubbed from the list. On the flipside, Barbados and Anguilla have been added to a list now holding 12 locations.

European Union finance ministers have put the Caribbean

jurisdictions of Anguilla and Barbados on its blacklist of

tax havens, but removed the Cayman Islands. It also took the Gulf

state of Oman from the list after these

jurisdictions passed required reforms.

The EU list, created in 2017, includes a total of 12

jurisdictions: American Samoa, Anguilla, Barbados, Fiji, Guam,

Palau, Panama, Samoa, Seychelles, Trinidad and Tobago, the US

Virgin Islands and Vanuatu.

The decision to take the Cayman Islands – a British Overseas

Territory – off the list came after the EU considered it to be a

fully co-operative jurisdiction for tax purposes.

A meeting of EU finance minister comprising the Economic and

Financial Affairs Council, aka ECOFIN, reached the decision

earlier this week.

The move recognises the Cayman Islands' compliance with the EU's

requirement that the Cayman Islands put "appropriate measures in

place relating to…collective investment vehicles". The Cayman

Islands put those appropriate measures in place by passing

private funds legislation earlier in 2020 and registering more

than 12,300 private funds with the Cayman Islands Monetary

Authority by 7 August 2020, as pointed out by offshore law firm

Maples in a note

yesterday.

“The EU's decision is a welcome recognition of the Cayman Islands

as a jurisdiction which is fully committed to implementing

international standards,” Maples said.

The Alternative Investment Management Association welcomed the EU

move.

“This action by the EU acknowledges that the regimes established

by the Cayman Islands for fund regulation and the wider economic

substance requirement, as well as those for the exchange of tax

and financial information, anti-money laundering and related

measures are fully in line with international standards,” Ronan

Guilfoyle, AIMA Cayman chairman, said.

Oman had been reinstated on the EU blacklist in 2019, having

earlier been removed from it.

The existence of such blacklists can be controversial, leading to

claims that the EU – home to several low-tax jurisdictions such

as Luxembourg and Malta – is hypocritical in favouring countries

that at times have come in for criticism.