Investment Strategies

GUEST ARTICLE: VAM On Opportunities In Smaller Cap Equities

The small-cap end of the US equity spectrum holds attractions, argues the author of this article.

As US equities have risen sharply – with some notable caveats – in recent years, where is there still value to be found for a tolerable level of risk? The author of this article, Jeff James, portfolio manager, VAM US Micro Cap Growth Fund and VAM US Small Cap Growth Fund, argues, perhaps unsurprisingly, in favour of the small-cap sector. Although the editors of this news service will not necessarily agree with all the views expressed, they are pleased to share such insights and invite readers to respond.

The historically strong returns of US smaller cap equities have

made them a staple of most wealth managers’ asset allocation

models. The inefficient nature and relatively large universe of

smaller US stocks provides ample opportunity for active managers

to invest in companies that are frequently overlooked or

underfollowed by investors.

While the equity market remains strong, risks abound. Economic and sentiment headwinds include: uneven economic growth; the timing of the Federal Reserve rate hike cycle; the risk of global deflation; increasing government regulations and slow growth outside the US. While these risks merit consideration, there are many industries with strong, positive economic drivers that are creating opportunities for US smaller cap equity investors.

We remain in an environment where transformative innovation will continue to provide leading growth companies with exceptional opportunities. Aggregate corporate earnings, profit margins and household wealth continue to expand. The job market is also improving, as the US is now posting the best employment growth since the late 1990s. After years of tight conditions, banks are relaxing lending standards with total bank loans growing at a high single digit rate, year over year. Several important economic multipliers such as new household formations, new business formations and total capital expenditures are expanding and will sustain economic growth.

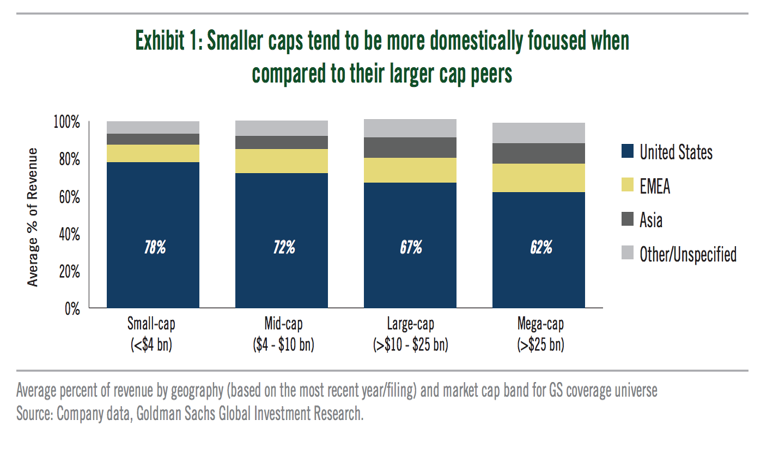

The US economy and the US dollar remain strong compared to the economies and currencies of other developed markets and many emerging markets. This is positive for the majority of US smaller cap companies that, unlike many larger companies, derive a higher percentage of their sales and earnings from within the US.

Also, reduced costs from lower crude oil prices and other weak commodity prices are an excellent tailwind for most smaller caps.

From a bottom-up perspective, there are numerous innovative smaller cap companies that are disrupting established industries. These innovators are creating new markets with new products and services that should enable them to grow at a substantially faster pace than that of the general economy. Examples include:

Consumer: There are a significant number of opportunities in the consumer discretionary sector, especially companies exposed to big-ticket discretionary purchases. Low interest rates, low gas prices, a rising stock market, improved consumer balance sheets, easing lending standards, an acceleration in housing sales, and rising employment levels have combined to push consumer confidence up to multiyear highs. When consumers are feeling good about their financial situation they are more willing to buy expensive discretionary items like cars, boats, RVs, furniture and other home goods.

However, while consumers are feeling more confident, not all retailers are seeing improving demand. Mall-based apparel retailers, for instance, are suffering from a lack of strong fashion trends, rapid store growth by domestic off-price retailers, and a loss of market share to online competition and to fast fashion retailers.

.jpg)

Health Care: There are opportunities in companies with exposure to product cycles in medtech (medical devices) and biotech companies with differentiated technologies and (disease) targets. In medtech, improving hospital volumes, improving discretionary spending, the annualisation of the medical device tax and its potential repeal have combined to create a favourable backdrop for companies introducing new and differentiated device technologies. The biotech industry has had a terrific run and valuations have expanded materially over the last several years. However, there is confidence that safe and highly efficacious drugs that address markets with undermet or unmet needs can command pricing power and create material value for shareholders as they move through development and regulatory approval.

Within the health care sector there is less enthusiasm for products and industries that have low barriers to entry, lack differentiation and are exposed to rapid changes in pricing, and those with old-generation technologies, commodity-like product offerings and reimbursement risks.

Technology: The technology sector has been synonymous with new product innovation since the introduction of the transistor in the late 1950s. Today, those innovations are creating opportunities within areas such as software, the cloud, security and semiconductors. Security is one of the fastest growing areas of information technology spending for enterprises and governments. Many security breaches have generated national media attention, however, incredibly, over 90% of such attacks go unidentified. To quote a CEO of a US security-related company referring to his potential customers, “everyone has a (security breach) story, and I mean everyone.”

Areas to avoid within technology are those where innovation is far less incremental and where customer demand is lumpy and lethargic, like PC-related companies, and telecom equipment providers and fibre optic suppliers that are exposed to the unpredictable and weak spending patterns of telecom carriers.

In summary, the investment and economic landscape is certainly mixed, with a number of risks that warrant monitoring, but the US economy has numerous positive drivers that should continue to provide a healthy environment for smaller cap equities. While it is a selective market, as a bottom-up, fundamental manager focused on earnings growth, we are encouraged as we continue to discover an attractive mix of differentiated smaller cap opportunities.

About the Author

Jeff James is the portfolio manager of the Driehaus Micro Cap

Growth and Small Cap Growth strategies employed by VAM Funds

(Lux). He has managed the Micro Cap Growth strategy since

1998 and the Small Cap Growth strategy since 2006. James began

his career with Lehman Brothers in 1990. From 1991 to 1997, he

worked at the Federal Reserve Bank of Chicago as an analyst.

James received his B.S. in finance from Indiana University in

1990 and his MBA from DePaul University in 1995