Offshore

GUEST ARTICLE: Ogier On The Cayman Islands' New Arbitration Law, Trusts & Dispute Resolutions

A new arbitration law is part of how the Cayman Islands seeks to make itself a more appealing offshore centre. Ogier, the law firm, examines trusts and disputes resolution issues in the jurisdiction.

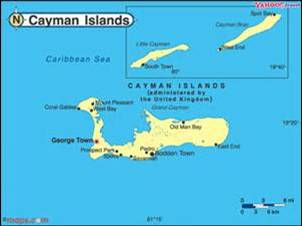

Jurisdictions, as readers of this publication know well, are

constantly battling to convince corporates and individuals they

have the most suitable offerings, whether they are trusts,

foundations, insurance structures or bank accounts. Industry

figures have said they expect consolidation in the total number

of offshore centres, with those that can deliver a varied

offering, clear specialisms and value-added services coming on

top. One of the most vigorous jurisdictions when it comes to

making its case is the Cayman Islands. The Caribbean centre

hasn’t always had an easy ride. The jurisdiction is, like another

centre, the British Virgin Islands, fearful about UK proposals

for a public register of beneficial ownership, which some centres

fear could compromise legitimate client confidentiality. These

centres are also anxious that they do not get frozen out of

markets such as the European Union due to the latter’s recently

enacted regime governing the marketing of alternative

investments, for example. But with thousands of funds and other

structures registered, the Cayman Islands remains one of the most

significant in the IFC landscape.

An important measure for judging the strengths of a jurisdiction

is its legal system and how efficiently disputes can be resolved.

Trust disputes are an inevitable part of such work. In this

article, Ulrich Payne, partner, and William Jones, senior

associate, in Ogier’s Cayman Islands dispute resolution team,

examine how trust disputes can be resolved in the Cayman Islands,

and give consideration to the jurisdiction’s new Arbitration Law

and how it might apply to trust disputes. The views of the

authors are not necessarily endorsed in full by the editors of

this publication but are an important addition to debate. Readers

are invited to respond.

Keeping in mind that “an ounce of prevention is worth a pound of

cure”, those setting up a new trust structure should consider at

the outset how to reduce the risk of disputes arising and

drafting with a view to limiting the scope and costs of a dispute

should one occur.

One of the first considerations for a potential settlor of a new

trust structure is the issue of selecting the jurisdiction (i.e.

the proper law) of the trust. There are a number of factors which

should be taken into account when choosing the proper law of a

trust:

- The courts: the first, and perhaps most important, factor

is whether the courts of the jurisdiction in question have

experience in dealing with trust disputes and whether they are

able to facilitate the quick and cost effective resolution of

such disputes;

- Expertise: a would-be settlor should take into

account the quality of the legal assistance which is available in

the jurisdiction and the question of whether specialist trust

advocates can be admitted to appear before the courts to conduct

trials, should the matter ever need to be litigated; and,

- Legislation: the settlor should also consider whether the

jurisdiction has firewall legislation such that the effect of

potentially relevant (but “disruptive”) foreign laws (such as

forced heirship legislation) can be avoided.

The Cayman Islands’ Grand Court established a dedicated Financial

Services Division (FSD) in November 2009 for the purposes of

managing complex commercial disputes, including most trust

disputes. The FSD has a panel of highly experienced commercial

judges, who are assigned to specific cases for the duration of

the proceedings. This allows the FSD’s judges to take an active

role in case management, with the aim of ensuring that disputes

are resolved as quickly and as efficiently as possible.

Furthermore, Cayman Islands law is based on English law and

benefits from the wealth of English common law precedent. There

is a considerable body of experienced legal professionals in the

Cayman Islands, and specialist advocates are commonly admitted to

appear in complex and high value matters.

The substantial talent pool is a particular benefit in trust

disputes, as there are typically multiple parties including the

trustee and the various beneficiary classes – each of whom

is likely to require separate representation.

Finally, the Cayman Islands was the first jurisdiction to

enact firewall legislation, which essentially requires any

disputes in relation to Cayman law trusts to be resolved in

accordance with Cayman law, to the exclusion of any foreign

matrimonial laws or foreign heirship rights which are not

consistent with Cayman law.

Having chosen the Cayman Islands for all of the reasons described

above, the settlor can take further comfort from the fact that

the Cayman Islands' law offers helpful choices with regard

to the way in which a trust dispute can be conducted.

First, there is often a desire to include a “no contest” clause

in the trust deed which has the effect of forfeiting the

interests of any beneficiary who attempts to challenge the trust.

Unlike several other jurisdictions where there have been

questions as to the validity of such clauses as a result of their

inherent conflict with a beneficiary’s power to enforce a trust,

in the Cayman Islands there are a number of judgments which

clearly show that a properly drafted no contest clause is valid

and enforceable.

Secondly, a settlor has the option to include an arbitration

clause. Although the majority of trust disputes in the

Cayman Islands have been traditionally resolved through

litigation in the courts, there is a growing interest in

arbitration, particularly following the enactment of the new

Arbitration Law in 2012, which contained revisions featuring an

increased focus upon impartiality, party autonomy, limited

judicial interference and wider tribunal powers.

In fact, the powers given to an arbitral tribunal appointed under

the Arbitration Law are wide enough to enable it to award any

interim or final remedy that the Cayman courts could grant.

However, note that arbitration would not be the appropriate

procedure where the relief sought needs to bind third parties –

such as court sanction for a trustee to take a momentous step or

Beddoe relief.

Perhaps the most significant benefit of the parties agreeing to

resolve a trust dispute through arbitral proceedings is that the

Arbitration Law imposes a duty of confidentiality on the parties

and that the proceedings will be conducted in private. As a

result, the proceedings will not be found on the court’s publicly

available register of writs and originating processes, and there

will be no publicly available judgment at the conclusion of the

dispute. Furthermore, arbitration proceedings are often more

flexible, can be more cost-effective, and will typically preclude

the possibility of an appeal – noting of course that that can be

a disadvantage in certain circumstances.

Therefore, when setting up a trust structure in the Cayman

Islands, it is worth bearing in mind that there are a number of

significant advantages obtained simply by including an

arbitration clause in the deed.