Investment Strategies

GUEST ARTICLE: Maitland Explores The "Lost Asset Class" Of Convertible Bonds

Maitland, the asset management firm, considers the investment case for an asset class that is in danger of being overlooked: convertible bonds.

The following article is by Greg Harris, senior investment manager at [tag]Maitland, the South Africa-headquartered asset management firm.

Few money managers would be willing to describe today’s global

equity markets as cheap or offering great long-term value (they

certainly offer less than 18 months ago). Similarly, the voices

supporting bonds as a long-term investment thesis have grown

steadily quieter, especially as the US Fed stands in the corner

ready to unleash further tapering.

Risk-taking investors are faced with a very basic conundrum – own

equities because there is nothing else you would rather own (and

the usual alternative to owning equities - i.e. bonds - is about

as attractive as you with a kebab in your hand at 3am) or become

more risk averse and hold cash.

The first possible solution to this conundrum is to entrust your

money to people who are still able to find the diamonds in the

rough, but remain exposed to the same asset classes. Short-term

performance for such managers can often diverge significantly

from market benchmarks and remaining invested requires patience

and a strong belief that you were skilled or lucky enough to

select the right manager.

A second possible solution is to find an alternative asset class

that offers a more attractive risk and return profile due to its

design rather than its current valuation. Enter convertible

bonds.

Convertible bonds are a relatively elusive yet fundamentally

attractive asset class. Very low issuance relative to traditional

bonds has in the majority kept them the preserve of professional

money managers.

A convertible bond is most easily thought of as a traditional

bond issued by company X, together with a call option on the

stock of company X. The owner of the convertible bond in effect

owns both a bond and a call option on the underlying equity,

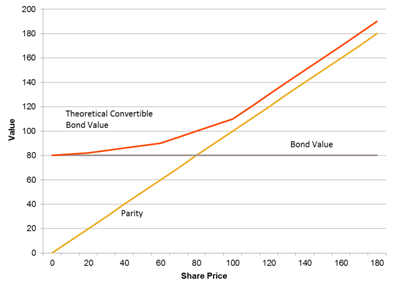

resulting in a payoff profile as shown in Chart 1.

Chart 1 – Convertible bond valuation as a function of

equity price

Globally convertible bonds shot to prominence during the 2008/09

financial crisis for all the wrong reasons. Up until then they

had been significantly invested into by convertible bond

arbitrage hedge funds and proprietary trading desks, which

estimates suggest accounted for 80 per cent of the market. The

funds had levered positions and during the turmoil needed to

reduce risk quickly.

The result was many sellers and few buyers, creating a liquidity

crush and pushing prices down, a very bad story for levered

investors. Even so, convertible bonds lost less than equities did

during 2008 and recovered strongly in 2009 as markets recovered

and liquidity normalised. The long-term risk-adjusted return

numbers are attractive relative to equities.

Today it is suggested that the investor base has changed

significantly, with a much larger institutional (and unlevered)

investor base that is less likely to be forced to close out

positions during a stress event.

The attraction of convertible bonds in a market such as we find

ourselves in today is that they share the positive

characteristics of both bonds and equities – if equities go up,

they will participate (to a varying extent) in the rally, and yet

if equities fall they should experience the capital preservation

characteristics of a traditional bond.

Much like equities, it is probably fair to say that convertibles

are priced reasonably and that this is not an allocation without

risk. However the very nature of a convertible bond, with its

asymmetric payoff profile, makes it an interesting instrument to

be exposed to at a time when there is much market manipulation by

central banks in asset markets.

Convertible bonds benefit during times of significant equity

dispersion as their convexity (increasing participation as

equities rise) means that you will often make much more on your

winners than what you will lose on the losers if you purchase

them close to the bond floor. Instrument selection is important,

but not as critical as for those in traditional

equities.

M&A activity

Convertible bonds have an added complexity due to their embedded

derivative nature, and many include clauses which protect the

owners in the event of a merger / acquisition of the company.

These terms vary by bond but can be massively advantageous to the

owners of the bonds. In a world of increasing M&A these

take-out premiums offer a further value enhancement strategy for

owners of the asset class, provided you know where to

look.

What is in it for the issuers?

Convertible bonds are attractive to CFOs who are able to keep

their cash borrowing costs down (i.e. the interest rate they pay

on borrowed money) by offering investors a "free" call option on

their stock. Inherently this must lead to some biases within the

convertible bond universe and cash-flush corporates who can raise

money at very low rates in nominal bond markets are unlikely to

be found issuing convertible bonds.

Investing in this market is a specialised activity and it would

be difficult for an investor to build a portfolio of names

without spending significant time researching the asset class,

and understanding the intricacies of each issue. There are

however a number of global funds with a variable focus on the

asset class and a handful that are managed by boutique

convertible bond managers that have focused solely on the asset

class for decades.

A couple of basic truths never change irrespective of the asset

class, that is don’t overpay for the underlying assets and

understand what you are buying.