Real Estate

Family Offices Should Capitalize On Distressed Multi-Family Properties

Investors with a long-term outlook such as family offices should consider opportunities in parts of the multi-family office space, given distressed prices and potential for value-add strategies, so the author of this article says.

Michael Criscito, a senior managing director in the real estate solutions practice and co-leader of real estate restructuring advisory services at FTI Consulting in Los Angeles, talks about the opportunities in multi-family property in the US, and how family offices can find opportunities in the sector.

The editors are pleased to share these views; the usual editorial disclaimers apply to opinions from outside contributors. Email tom.burroughes@wealthbriefing.com if you wish to comment.

The state of multi-family property performance and the distress

in the market reflect a combination of economic, operational and

market-specific factors. A quick recap of the current market

dynamics is important to set the stage for prospective

investors.

Many distressed multi-family properties are facing financial burdens, with owners unable to meet debt service requirements or defaulting on loans. Higher interest rates in general and stricter lending standards on distressed properties specifically have increased the cost of borrowing. making it more difficult to service existing debt or secure financing for acquisition or improvement.

Operational challenges due to higher-than-average vacancy rates, pressure on rental rates and significant increases in expenses are also stressing this sector, stemming from poor management and lack of proper maintenance protocols. Owners of many distressed properties have deferred necessary repairs and upgrades due to financial constraints. Others face legal disputes that can complicate ownership and operation.

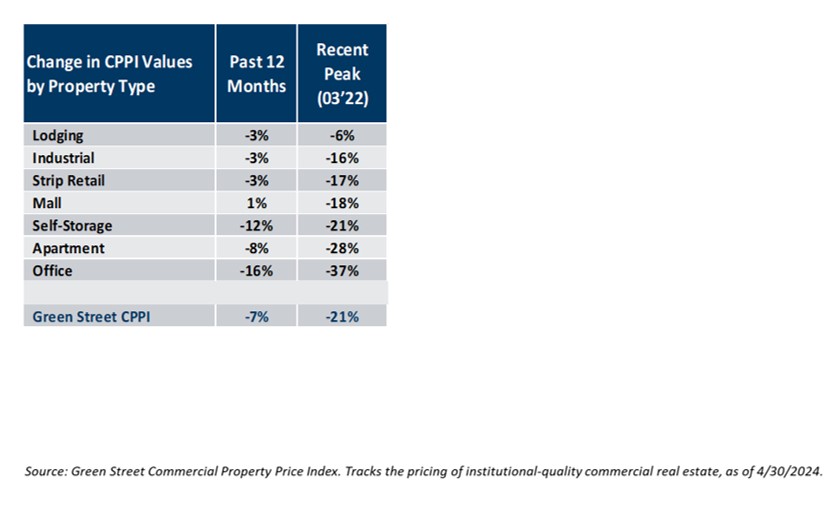

As a result, multi-family values have declined by 28 per cent since the peak in March 2022.

In addition, the performance of multi-family loans continues to

deteriorate which will provide distressed investors with good

opportunities to purchase loans/assets.

These issues beg the question: why is it the right time for

family offices to take advantage of this market dislocation?

First, there is significant investor competition for

assets/loans, and sellers are looking for the best execution and

certainty of closing. Family offices that invest in real estate

have a competitive advantage for the following reasons.

-- Long-term investment horizon: Family offices typically

focus on long-term wealth preservation and gradual growth across

generations.

-- Flexible investment strategies: This flexibility allows family offices to capitalize on unique opportunities and manage risks more effectively.

-- Direct ownership and control over investments: This preference enables family offices to make strategic decisions regarding property management and improvement.

-- Capital appreciation: Family offices often aim for substantial capital appreciation through property improvements, value-add strategies and market appreciation over time.

-- Steady income stream: Rental income provides cash flow, which contributes to the overall return.

-- Lower leverage: Family offices might use lower leverage compared with other investors, aiming for stability and lower risk, which can moderate returns but also reduce volatility.

-- Targeted returns: Typical return targets can range from 8

per cent to 15 per cent annually, considering both income and

appreciation.

Secondly, the market dynamics for this asset class appear likely

to remain strong over the long term, as evidenced by continued

high demand for rental housing.

This sustained demand is driven by increasing urbanization, the

rise of remote work and flexible live/work arrangements, and a

growing preference among younger populations for renting over

home ownership. Millennials and Gen Zers, a significant portion

of the renter demographic, continue to drive demand for

multi-family units, especially in urban and suburban areas.

Housing affordability challenges are also pushing more people

into the rental market.

However, the multi-family market faces challenges from rising interest rates, supply constraints (due to high construction costs and labor shortages) and regulatory changes. Despite those conditions, investors continue to find opportunities, particularly in regions with favorable economic and demographic trends (such as the Sunbelt currently), while distressed properties present potential value-add prospects. As the market evolves, a focus on operational efficiencies, sustainability, and adapting to regulatory demands will be key for successful investment in the multi-family sector.

Finally, multi-family distressed properties can present excellent buying opportunities for family offices, for several reasons:

1. These properties often sell at prices below market value due to financial difficulties faced by the current owners, such as missed mortgage payments, foreclosure, or bankruptcy. This situation can lead to significant savings and the potential for high returns on investment. Motivated sellers, including banks looking to offload non-performing assets or owners eager to avoid further financial distress, may be more inclined to sell quickly. This urgency can create better negotiation terms for buyers, allowing them to secure properties at even more favorable prices.

2. Distressed properties typically require repairs or upgrades, which presents a valuable opportunity for family offices. Investing in renovations can improve the property's condition, thereby increasing its market value and rental income potential. For example, updating outdated facilities, enhancing curb appeal, or adding modern amenities can attract higher-paying tenants. Implementing better management practices and operational efficiencies, such as professional property management, optimized tenant screening, and maintenance schedules, can further enhance property performance and profitability.

3. Investing in multi-family properties offers portfolio diversification and attractive returns for family offices. Adding multi-family units to their real estate holdings can reduce overall investment risk because, unlike single-family rentals, multi-family properties spread risk across multiple units, providing a more stable cash flow. Even if one unit is vacant, others continue generating income, thereby stabilizing the investment.

4. Tax advantages may further enhance the attractiveness of these investments. For instance, investors can benefit from property depreciation and deduct a portion of the property's value from their taxable income each year. Additionally, through 1031 exchanges, family offices can defer capital gains taxes by reinvesting proceeds from the sale of a property into a similar investment, thereby preserving more capital for future investments – and generations.

5. Moreover, some financial institutions offer specialized financing for distressed properties. These loans often come with favorable terms, such as lower interest rates or flexible repayment plans, to facilitate the properties’ sale and rehabilitation. Government programs and incentives aimed at revitalizing distressed areas can provide additional financial benefits, such as grants, tax credits, or low-interest loans.

6. Investing in distressed properties can have a positive community and social impact. By revitalizing neighborhoods, family offices can improve the quality of life for residents, contribute to local economic development and enhance community aesthetics. Aligning investments with social responsibility goals, such as improving housing standards and providing affordable housing options, can fulfill corporate social responsibility objectives and generate goodwill in the community.

In summary, multi-family distressed properties can offer significant potential for long-term financial gain and social impact. The prospect of purchasing at discounted prices, adding value through renovations, capitalizing on strong rental demand, diversifying investment portfolios, enjoying tax benefits, securing favorable financing, and contributing to community revitalization can make these properties an attractive option for family offices.

Conclusion

Distressed multi-family properties are characterized by financial

difficulties, operational inefficiencies, physical condition

issues and challenging market conditions.

These properties often require significant investment and

strategic management to address deferred maintenance, improve

occupancy rates and achieve financial stability. For investors,

especially family offices with a long-term perspective,

distressed multi-family properties can present opportunities to

acquire assets at discounted prices, implement value-add

strategies, and potentially realize substantial returns through

rehabilitation and improved management, which foster continued

renter demand.

Disclaimer

The views expressed herein are those of the author(s) and not necessarily the views of FTI Consulting, Inc, its management, its subsidiaries, its affiliates or its other professionals. FTI Consulting, Inc, including its subsidiaries and affiliates, is a consulting firm and is not a certified public accounting firm or a law firm.

FTI Consulting is an independent global business advisory firm dedicated to helping organizations manage change, mitigate risk and resolve disputes: financial, legal, operational, political & regulatory, reputational and transactional. FTI Consulting professionals, located in all major business centers throughout the world, work closely with clients to anticipate, illuminate and overcome complex business challenges and opportunities. © 2024 FTI Consulting, Inc. All rights reserved. fticonsulting.com