Executive Pay

Executive Pay Watch: How Shareholders Voted At UK Top 350 CompaniesÂ

How did shareholders vote, and what level of dissent did they give voice to in the annual general meetings held by UK firms during the spring season? This article explores the details and crunches the numbers.

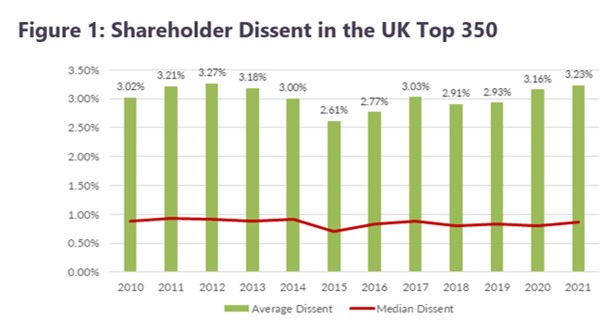

This month the team at independent corporate governance and proxy voting service Minerva Analytics looks at voting trends and shareholder dissent at the UK’s top 350 companies. Average overall dissent across all resolutions considered at shareholder meetings of the UK’s largest 350 companies was 3.23 per cent in the first half of 2021. Figure 1 below illustrates the mean and median yearly dissent over time. The voting results for the first half of the year suggests that the recent upward trend seen in shareholder dissent has continued this voting season.

High dissent resolutions

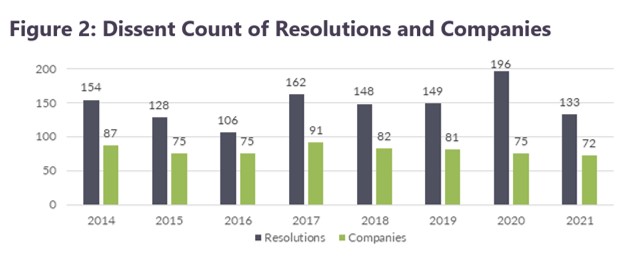

The chart below shows the number of companies and the number of

resolutions that received high dissent over the past eight years

since investors have had a binding vote on remuneration

policy.

In the first half of 2021, 72 companies have received 20 per cent

dissent or more on at least one resolution. Notably, over half

(52.78 per cent) were repeat offenders, meaning that the company

also received high dissent in 2020. This data would seem to

suggest a breakdown in communication between companies and

shareholders: either companies are not listening to feedback, or

shareholders are not explaining effectively - or possibly a

mixture of both.

Within the review period, 21 resolutions proposed by management

were voted down by shareholders. This compares with the 23

defeated resolutions in the full 2020 calendar year. The data

show that more resolutions have been voted down by shareholders

in the first half of 2021 than in each of the full calendar years

of 2014 to 2019. The results indicate that 2021 could become the

new record year for defeated management resolutions when all

shareholder meetings have been held and voting results

collected.

Remuneration

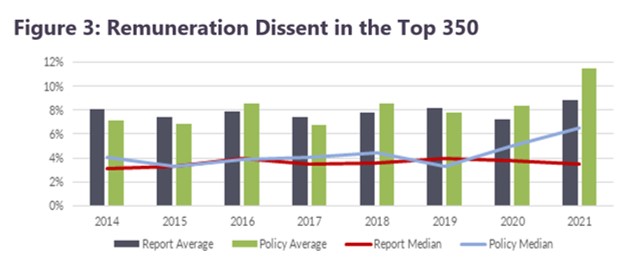

Executive pay continues to be a high-profile issue and

remuneration-related resolutions prove to be the most

consistently contentious resolution category of those routinely

proposed by management. The dissent level on remuneration

resolutions in the first half of the year stands at its highest

level since binding remuneration policy votes were introduced in

2014. Remuneration-related resolutions received on average 8.72

per cent shareholder dissent, more than double the 3.23 per cent

average. Notably, the average dissent on remuneration policy

resolutions in the first half of 2021 is over 10 per cent for the

first time.

Remuneration-related resolutions have overtaken board-related

resolutions for the highest count of high dissent resolutions in

2021. There were 60 high dissent remuneration-related

resolutions, more than the 59 remuneration-related resolutions in

the whole of 2020. The primary drivers behind the dissent appear

to be remuneration complexity, base pay increases larger than the

wider workforce, and the continuing impact of COVID-19 concerning

the use of discretion and/or adjustments.

During the 2020 and 2021 voting seasons, several companies have

adjusted their approach to remuneration in response to the

economic impact of the pandemic. The most common changes have

been a temporary reduction in base pay, a freeze on salary rates

and a delay in target setting. Other companies also adjusted

incentive pay outcomes, with some deferring annual bonus pay-outs

or cancelling the bonus in full.

Shareholders expect executive remuneration to be aligned with the

overall experience of the company, its shareholders, employees,

and other stakeholders. Institutional guidelines have also set

out an expectation for the use of government support, staff

redundancies, raising additional capital from shareholders and

the suspension of dividends and/or share buybacks to be reflected

in remuneration outcomes.

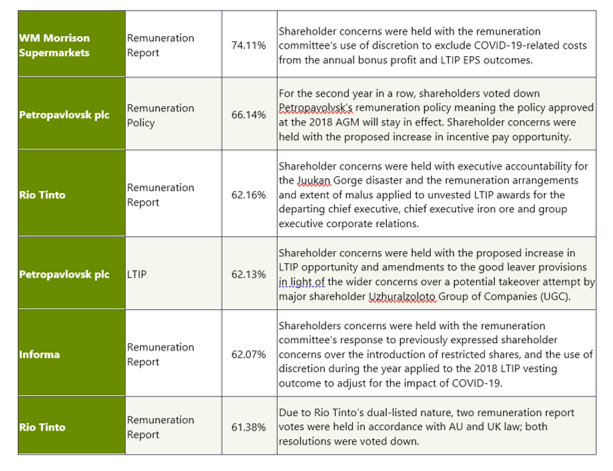

Despite clear shareholder expectations, many companies still

received high dissent due to perceptions of doing the wrong

thing. In some cases, the company in question receiving high

dissent had performed strongly but still received high dissent,

potentially indicating a wider attitude shift on remuneration and

societal expectations on fairness and shared sacrifice during the

pandemic.

These trends suggest that remuneration continues to dominate the

headlines and shareholder-board engagement. It also appears that

remuneration is increasingly being considered through an ESG

lens, with a number of the highest dissent resolutions connected

to ESG issues and questions over fairness and societal

expectations on responsible business behaviour during the

pandemic.

Methodology

For the purposes of this analysis, dissenting votes are those

purposely not cast in favour of a management proposal and include

both “abstain” and “against” votes. Under UK company law,

abstentions currently have no legal authority, but over many

years they have become a strong indicator of shareholder

sentiment and are used to demonstrate that they cannot fully

offer their support.

Companies have been classified as being a top 350 company as at

the date of their shareholder meeting during review period. The

period 2010 to 2020 covers a full year’s data while 2020 includes

1 January to 30 June.

The full voting review is available at:

www.manifest.co.uk/downloads/2021-uk-proxy-season-review