Executive Pay

Executive Pay Watch: Financial Services: New MIFIDPRU Remuneration

Investment firms that come under the umbrella of the European Union's MiFID II directive - a regime that continues to apply to UK firms as MiFID II took force prior to Brexit - have a new remuneration code to contend with. This article delves into the details.

The UK's Financial Conduct Authority has now published its near final rules for the single remuneration code for MIFID investment firms.

The new code will replace the existing BIPRU and IFPRU

Remuneration Codes and will be known as the MIFIDPRU Remuneration

Code (“MIFIDPRU”). MIFIDPRU will apply to performance periods

beginning on or after 1 January 2022 and will require many firms

to implement changes to their reward policies and practices. A

copy of the FCA Policy Statement (PS21/9) containing the near

final rules can be

found here.

Background

MIFIDPRU is based on (but differs in some respects from) the

remuneration rules set out in the EU Investment Firms Regulation

((EU) 2019/2033) (IFR) and the Investment Firms Directive ((EU)

2019/2034) (IFD). The FCA’s stated objectives are to:

-- promote effective risk management in the long-term

interests of the firm and its customers;

-- ensure alignment between risk and individual reward;

-- support positive behaviours and healthy firm cultures; and

-- discourage behaviours that can lead to misconduct and poor

customer outcomes.[1]

MIFIDPRU will apply to performance periods beginning on or after

1 January 2022. Importantly the focus is on the ‘performance

period’ rather than the date on which remuneration is awarded or

paid out.

This means that firms currently subject to the existing IFPRU

and/or BIPRU Remuneration Codes should continue to apply those

rules in respect of remuneration paid in 2022 which relates to

performance or services provided during a period which started

before 1 January 2022.

Overview of the MIFIDPRU Remuneration Code

The extent to which the MIFIDPRU Remuneration Code applies to a

firm depends on how it is categorised under the new Investment

Firm Prudential Regime (IFPR). Broadly speaking, this

categorisation is based on a number of financial thresholds, the

details of which can be found in the FCA’s IFPR publications.[2]

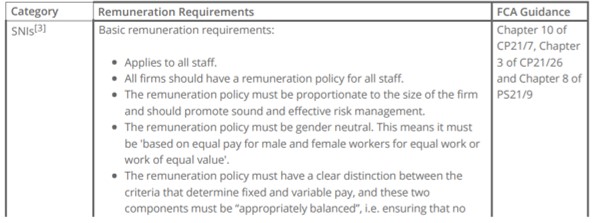

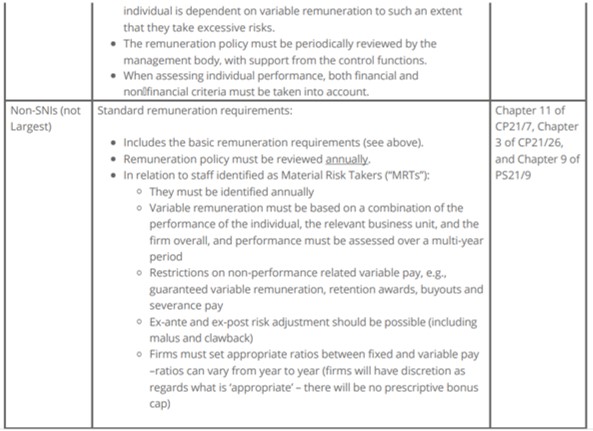

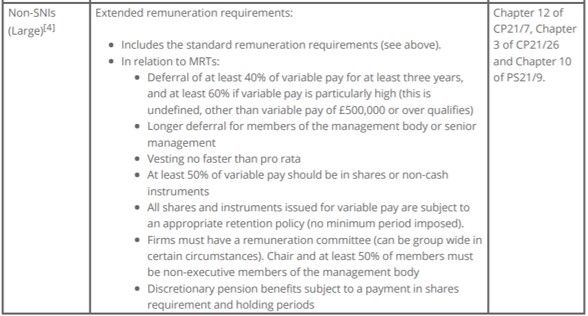

There are three categories:

-- Smaller and non-interconnected firms (SNIs);

-- Non-SNIs; and

-- Largest non-SNIs.

We have summarised the main requirements in the table below (the

disclosure requirements are covered separately below).

Further Analysis

Gender-neutral

Some respondents to an earlier IFPR discussion paper queried why

the remuneration policy should be gender-neutral, since that is

already a requirement of the equal pay legislation. However, the

FCA wanted to include it to “support and reaffirm our aim to

drive healthy purposeful cultures in firms, which includes

developing an inclusive and diverse workplace."

[5]

This requirement will not impose any additional burden on

firms.

Conflicts of interest

The FCA have said that in order to mitigate the risk of conflicts

of interest arising, no variable remuneration should be awarded

to members of the management body who do not perform any

executive function in the firm, e.g. non-executive

directors.[6]

Disclosure requirements

The FCA requires certain remuneration information to be publicly

disclosed, namely:[7] the key characteristics of their

remuneration policies and practices; certain quantitative

disclosures about the remuneration outcomes of their staff; the

types of staff they have identified as MRTs (non-SNI firms

only).

In line with its approach to proportionality under the MIFIDPRU

Remuneration Code, a firm must disclose information in line with

its category under the MIFIDPRU Remuneration Code (see above).

Larger firms are expected to disclose more detail. Disclosures

need to be easily accessible and understandable by stakeholders,

so firms will need to publish their disclosures in an

easily-found part of their website and use easily-understood

language and diagrams, where relevant. Firms must publish their

disclosures annually, alongside their annual financial statements

(or annual solvency statement). Disclosures should be made more

frequently if a firm undergoes a significant change, e.g. a

merger or acquisition.

Material risk takers

MRTs are to be identified based on certain criteria. The FCA

said: “The aim is to identify all those individuals whose

professional activities can have a material impact on the risk

profile of the firm or the assets it manages. In conducting this

exercise, an FCA investment firm should consider all types of

risks involved in its professional activities. These may include

prudential, operational, market, conduct and reputational

risks.”

[8] There is no requirement to identify MRTs based on

remuneration alone, as this is not a reliable indicator of the

level of risk involved in a particular role within a firm.

Instead, the assessment will be made based on qualitative

criteria.

For large non-SNI firms to which the extended remuneration

requirements apply, MRTs are exempt from those rules if (i) they

receive variable remuneration of £167,000 or less, and (ii) that

variable remuneration makes up one third or less of their total

remuneration.[9] Both criteria must be met for the exemption to

apply. However, note that this exemption only applies with

respect to the extended remuneration requirements and the basic

and standard remuneration requirements will still apply to those

MRTs.

Malus and clawback

Firms must determine their own triggers for applying malus or

clawback. However, the FCA has said that malus should be applied

where i) there is reasonable evidence of employee misbehaviour or

material error, ii) the firm or the relevant business unit

suffers a material downturn in its financial performance, or iii)

the firm or the relevant business unit suffers a material failure

of risk management, and clawback should always be applied in

cases of fraud or other conduct with intent or severe negligence

which led to significant losses. For large non-SNIs, their

remuneration policies must include the possibility of applying

in-year adjustments, malus and clawback.[10]

Non-performance related variable

remuneration

The MIFIDPRU Remuneration Code includes rules and guidance on the

use of non-performance related variable remuneration, e.g.

guaranteed variable remuneration, retention awards, buy-out

awards and severance pay for MRTs.[11] Guaranteed variable

remuneration (also referred to as a “sign-on bonus” or “golden

handshake”) should only be awarded to MRTs rarely and not as

common practice, in the context of hiring a new MRT, in the first

year of service and where the firm has a strong capital base.

Retention awards are permitted but should be used only rarely

(e.g. in the context of specific projects) and should be awarded

only after the retention period has ended.

Buy-out awards involve a firm compensating a new employee whose

deferred variable remuneration was reduced by their previous

employer. Non-SNIs must ensure that the buy-out is aligned with

the long-term interests of their firm and remains subject to the

same pay-out terms required by the previous employer, e.g. by

following the same deferral and vesting schedule. Non-SNIs should

set out any criteria for determining severance pay in their

remuneration policy and all severance payments must reflect the

individual’s performance over time and must not reward failure or

misconduct.

Discretionary pensions benefits

For the purposes of the application of remuneration rules,

discretionary pension benefits are treated as a form of variable

remuneration. Under the new rules, all non-SNIs will be required

to ensure that all discretionary pension benefits are in line

with the business strategy, objectives, values and long-term

interests of the firm; award the full amount in shares,

instruments or within any alternative arrangements the FCA has

approved; and apply malus and clawback to discretionary pension

benefits in the same way as to other elements of variable

remuneration.[12]

In addition, under the extended remuneration requirements, if an

MRT leaves the firm before retirement age, non-SNIs must hold

these discretionary pension benefits for five years in the form

of shares, instruments or within any alternative arrangements.

Where the MRT leaves the firm upon reaching retirement age, the

pension benefits must be paid out in shares, instruments or

within any alternative arrangements and the MRT must retain them

for five years.[13]

Co-investments and carried interest

There are new rules on co-investments and carried interest [14]

and the FCA has confirmed that the MIFIDPRU Remuneration Code

applies to carried interest and that carried interest must be

valued at the time of its award.[15]

The FCA said they would not usually consider returns made by

staff on co-investment arrangements to be remuneration for the

purposes of its rules, but they would usually consider carried

interest to be remuneration.

Next steps

These are the steps firms should be thinking about ahead of 1

January 2022:

-- Assess which category of firm applies based on the

financial thresholds (e.g. SNI);

-- Consider whether remuneration policies and practices should be

reviewed and amended;

-- Non-SNIs will need to determine which individuals are MRTs

(which is likely to be wider than those carrying out;

-- senior management functions) and carry out a review of those

individuals’ remuneration.

-- Large non-SNIs will need to consider whether they meet the

requirements with respect to remuneration committees.

-- Careful analysis will be needed by firms that are part of

groups, including looking at applicable group consolidation

rules;

-- Multinational firms subject to MIFIDPRU Remuneration Code as

well as IFD and IFR remuneration rules in other jurisdictions

will need to consider issues such as the interaction of the

regimes and the extent to which employees outside the UK might be

caught by MIFIDPRU;

-- Firms will need to come to terms with the new disclosure

requirements and assess what needs to be disclosed and

when.

This article was first published in Thomson Reuters on Thursday 19 August 2021

Footnotes

[1] See para 9.7 of CP21/7

[2] For details of the categorisation of investment firms, see

section 2 of CP20/24, section 2 of PS21/6 and paras 2.17-2.19 of

PS21/9.

[3] For details of the definition of SNIs, see paras 2.3-2.11 of

CP20/24 and section 2 of PS21/6.

[4] A firm falls into this category if its i) on- and off-balance

sheet assets over a 4-year period have a rolling average of more

than £300m or ii) over the same period its on- and off-balance

sheet assets have a rolling average of more than £100m, and it

has a trading book business of over £150m, and/or derivatives

business of over £100m. For further details of these thresholds

and how they should be applied by firms, see para 9.22 of CP21/7

and section 7 of PS21/9.

[5] Para 10.11 of CP21/7

[6] Para 10.19 of CP21/7; SYSC 19G.2.12R

[7] Para 3.53 – 3.69 of CP21/26 (see Tables 3 and 4).

[8] Para 9.56 to 9.58 of CP21/7 and section 7 of PS21/9 sets out

more guidance on who should be characterised as a MRT.

[9] See paras 7.39 – 7.43 PS21/9. Note that the FCA has asked for

representations from stakeholders, so these figures might

change

[10] See paras 11.9 – 11.22 of CP21/7 and paras 9.17 – 9.19 of

PS21/9

[11] See paras 11.27 – 11.37 of CP21/7 and paras 9.22-9.30 of

PS21/9

[12] Paras 11.40 – 11.41 of CP21/7

[13] Paras 12.25-12.26 of CP21/7.

[14] See paras 8.11 – 8.17 of PS21/9 and guidance at SYSC 19G.4

for further details.

[15] Para 8.15 of PS21/9.