Client Affairs

Elder Care "Needs A New Narrative"

That was the assessment of Baroness Ros Altmann speaking at an elder care summit last week in London as specialists gathered to discuss findings of a report on the looming retirement crisis. Its conclusions should seize wealth managers' attention.

Ahead of the first budget under the new Conservative government this month, Irwin Mitchell issued a recent sharp warning about the state of UK care for the elderly, saying that the system will collapse within 10 years unless decisive policy action across parties is taken. The comments come in a report from the integrated law firm which has increasingly specialised in elder care and capacity issues and the intervening financial and health care planning needed to avert a crisis.

The study co-authored by the Centre for Economics and Business Research, and of concern for many wealth managers, shows the extent of pension shortfalls and rising dementia that are driving up care costs and affecting even those who consider themselves well off heading into retirement.

It found that care-funding shortfalls are expected to more than double over the next five years to £3.5 billion ($4.5 billion), and despite the relative success of auto-enrolment pensions introduced in 2012, many pots are nowhere near meeting future care needs. CEBR estimates that workers need to save £575 more per month than they are currently doing to comfortably fund their retirement.

“Only around the top 10 per cent of retired households by income can afford to pay for nursing homes from their income, and with the cost of care set to rise, many more elderly people will find themselves using up their wealth, or turning to local authorities for support to pay for care in the future,” Josie Dent, a senior economist at CEBR said.

The findings ought to concern even high net worth and ultra-HNW individuals who may think that their wealth will help ease the strains of such developments. Issues around ageing, cognitive decline, controversies over lasting powers of attorney and the status of wills all have become important for the wealth industry in recent years.

The Irwin Mitchell report raises what few are openly discussing in wealth management - the question of how much of the promised trillions in intergenerational wealth set to pass down from Boomers will be eaten away once 30 to 40 years of private health and care costs have been factored in.

The report found that nursing home costs are expected to rise by around 18 per cent over the next 10 years, bringing the average annual cost to £54,375. Even for the better off, these are unsettling issues for a population living perhaps decades longer in retirement than previous generations and statistically in poorer health. The Alzheimer’s Society projects that a million people will be diagnosed with dementia in the UK by 2025, which is expected to double by 2050. One in five currently in the UK is over 65. That will drop to one in four by 2050.

At a London conference the firm held last week to discuss the findings and raise awareness of retirement costs across the industry, former pensions minister Baroness Ros Altmann chairing the panel (and pictured above) argued that “almost no-one” in government has planned for long-term societal care. “Neither central nor local government has a sustainable plan to pay for care and there are no incentives for private individuals to set aside funds to meet later life care needs,” she said.

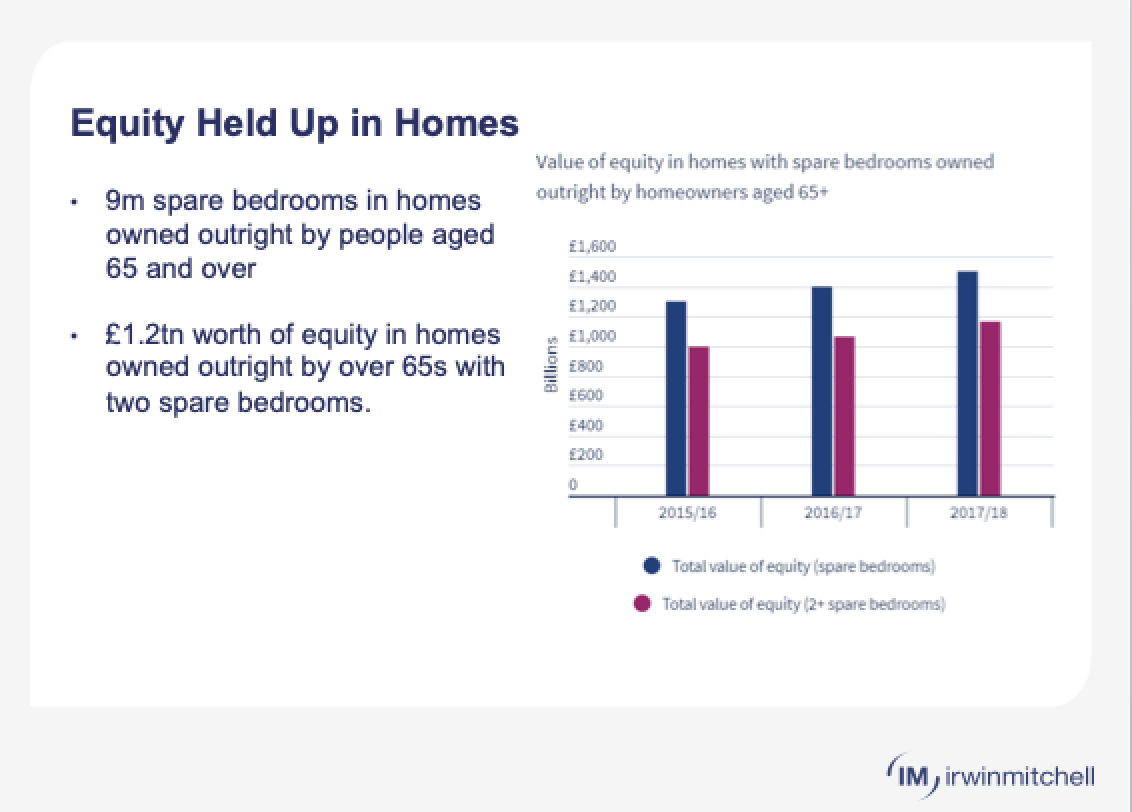

Across disciplines represented on the panel, including in real estate, asset management, pensions and elder and capacity care, the main pinch points were discussed. In property, neglected areas have been building sufficient desirable “retirement” spaces to entice Boomers into downsizing; this would free up stock better suited to younger families and release equity that the report puts at £1.2 trillion. Existing policy is almost entirely focused on helping the young get on the ladder rather than helping the old get off the ladder, is how Jeremy Raj in Irwin Mitchell’s residential division described the government approach. “Planning and land supply are two huge hurdles to getting suitable retirement homes built and national and local government don’t get this," added Guy Sackett, partner and head of retirement living at the firm. The US, Canada, Australia and New Zealand are streets ahead of the UK on this issue, he said.

When families come to sell the home, there is no underestimating the emotional attachment they have in giving it up to support residential care, Raj said. ”Some families are also surprised to find there has been equity release already and little left to cover parental care. "We are at the sharp end of this," he said.

Richard Potts, CEO of IM asset management, said that while equity release has offered some “benefits,” there have also been “severe disadvantages” for clients. “They tend not to be good value but it is sometimes all that people have got." He questioned the quality of retirement investment advice and said there are still too many people who don’t seek advice, don’t trust the advice they are given, and that the industry still needs to clean up its act.

Partner and pensions specialist Penny Cogher said that around eight million over 60s have over £40,000 in ISAs that could receive the same tax breaks as pensions to put against care costs. She also recommended taking a leaf out of the Netherlands’ book of four days of work and the fifth day goes towards your pension.

Responding to questions about the role of insurance, the panel agreed that the annuity market for retirement cover has "dried up.” Kelly Greig, head of later life planning at Irwin Mitchel, spoke of a client who took out pre-paid care decades ago which has paid out £4,000 a month for the past 17 years to cover a comfortable retirement. “Those products don’t exist any more, because insurers made huge losses.”

Lords member and long-time pension campaigner Altmann warned that pensions are no longer fit for purpose. They are designed to support independent living, not the escalating care costs people face now, adding that “massive policy failure" by successive governments "means there is no silver bullet solution.”

There are measures families can take, she said, “but there are also important policy reforms which could help alleviate this crisis. The recommendations of this report should be taken seriously by government.”

Those recommendations include calling on the government and local councils to review and reform the care funding system; change the eligibility criteria for support in paying for care (this has not been revised since 2011 and stands at £23,250); require councils to plan and allocate land for retirement, care and nursing homes; educate workers on the importance of pensions savings; and support informal carers looking after elderly people. The report reckons that this informal unpaid care by family members helping relatives props up the current system by £60 billion.

Greig added that families should consider care home fee planning alongside other major financial commitments such as pensions and mortgages. “Proper tax planning and mitigation can also help the public prepare for later life regardless of what government is doing,” she said.

For wealth planners, treating later-life care as a “financial priority” will go some way to making the UK public prepared for its realities, Greig said.