Offshore

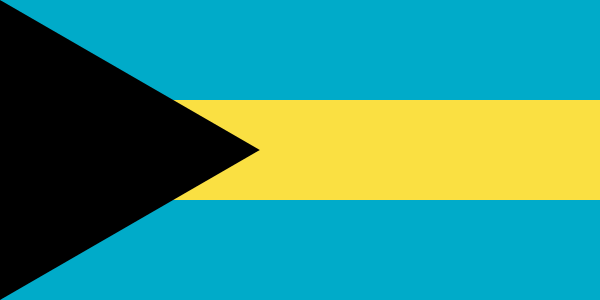

EU Takes The Bahamas Off "Grey List"

The Caribbean jurisdiction is no longer on a list of places deemed not fully co-operative about tax matters. Getting off the list will be a boost as The Bahamas continues to recover from last autumn's devastating hurricane.

Following a series of reforms, the European Union has now removed

The Bahamas from a list of non-cooperative jurisdictions for tax

purposes.

This was effected by the EU’s Economic and Financial Affairs

Council after a meeting in Brussels yesterday, according to a

statement from the Central Communications Unit, Ministry of

Finance in the country.

In March last year the EU put The Bahamas - which operates under

English common law and is an independent state - on the EU’s

Annex II “the grey list”.

While being included on the list is less serious than being on

the “Annex I black list” of the EU list of non-cooperative

jurisdictions for tax purposes, the categorisation still meant

that The Bahamas was being monitored by the EU to see whether it

was putting economic substance requirements into force.

(“Substance” relates to steps that providers of entities such as

trusts and companies must show to prove that they are involved in

actual commercial/economic activity and are not just an empty

shell for tax or other purposes.)

“With today’s move, The Bahamas has addressed all of the concerns

on economic substance, removal of preferential exemptions and

automatic exchange of tax information,” the statement

said.

“This news of our removal from the EU list affirms that The

Bahamas takes its position as a global financial centre very

seriously. Coming off this list was not an easy process. We

engaged many stakeholders and executed a comprehensive strategy

to not only address the EU’s concerns but also to defend the

jurisdiction against recent attacks on the legitimacy of our

financial services business,” said Deputy Prime Minister and

Minister of Finance, Kevin Peter Turnquest.

The statement said that figures from the government’s technical

advisor team met with the EU’s Code of Conduct Group to engage in

discussions on the integrity of The Bahamas’ tax governance

measures. Most of the discussions centred on the introduction of

economic substance requirements for investment funds.

Reaction

The Bahamas Financial Services Board and Association of International Bank and Trust Companies in the Bahamas welcomed the EU’s move.

“This was done in recognition of The Bahamas having implemented all of the necessary reforms to meet the EU criteria on tax governance and tax cooperation. The move by the EU underscores The Bahamas’ commitment to adhere to global regulations and international best practices as a premiere international financial centre. The decision acknowledges that The Bahamas has implemented all the necessary reform to address concerns regarding economic substance, removal of preferential exemptions and automatic exchange of tax information,” the groups said.

The Bahamas was one of 16 jurisdictions that the EU determined had passed legislation to meet EU tax good governance principles, while four new jurisdictions were added to the list of non-cooperative tax jurisdictions, the organisations said.

Getting a clean bill of health from the EU will also be a welcome

move for a jurisdiction still coping with the devastation of last

year's Hurricane Dorian. (The publisher of this news service has

also issued a report in conjunction with The Bahamas about

its financial services offerings.)

Meanwhile, a campaign organisation that continues to condemn tax

evasion and forms of avoidance, the Tax Justice Network, has

awarded the Cayman Islands the dubious honour of being the

world’s most secretive jurisdiction. The Bahamas, a nearby

Caribbean jurisdiction, does not figure in the top ten.