Asset Management

Disciplined Bitcoin Investing Can Pep Up Portfolios - Nickel Digital Asset Management

We talk to a founder of a new London-based investment firm that holds bitcoin. It argues that when managed in a controlled manner, exposure to the cryptocurrency can add valuable returns to a portfolio. Price action in bitcoin remains volatile.

There’s a drumbeat of noise around bitcoin. The

cryptocurrency is becoming more mainstream although price

action remains unnerving at times. It is drawing backing

from banks and institutional investors. The “Wild West”

perception of these “coins” is shifting. To give just one

example, Guggenheim

Partners, the US investment firm, last November reportedly

filed with the US Securities Exchange Commission to enable one of

its funds, dubbed the Macro Opportunities Fund, to allocate

millions of dollars in bitcoin.

Bitcoin has been propelled by a desire for “apolitical money”

that isn’t at the mercy of governments and money-printing central

banks, as well as by a desire for privacy and interest in the

possibilities of tech.

Price action in the currency has been volatile, and certain

governments remain wary, fearful that it can be used as a channel

for dirty money. (Defenders say transactions actually leave an

audit trail and that they aren’t totally anonymous.) In early

January bitcoin surged to more than $41,000 per coin; it fell

back towards the $30,000 point and has since gained. As of

yesterday, it fetched around $36,900, according to Coindesk, a

popular platform.

Former investment bankers and industry experts are moving into

the space. One recent example is that of Nickel

Digital Asset Management. The firm went live in June 2019,

founded by three people and now has a team of 20 staff, with

senior management coming from Goldman, JP Morgan, Bankers Trust,

Morgan Stanley, Rothchild, Bank of America, UBS and few major

hedge funds. The founders are Anatoly Crachilov, Michael Hall and

Alek Kloda.

This news service recently spoke to Crachilov about Nickel and

his ambitions for the business.

“We intend to further expand the offering by expanding the suite

of investment solutions, offering various access points to the

digital asset market, while adhering to the principles of

transparency and efficiency,” he told this publication. “People

should have some exposure to the asset class.”

A core part of Crachilov’s argument is that holding some bitcoin

in a portfolio can, because of the cryptocurrency’s qualities,

offer downside protection, although if portfolio holdings rise

above a certain percentage, it can make investments more

volatile. Bitcoin can strengthen a portfolio in small amounts,

rather as nickel is an important metal alloy ingredient - hence

the name of Crachilov’s firm.

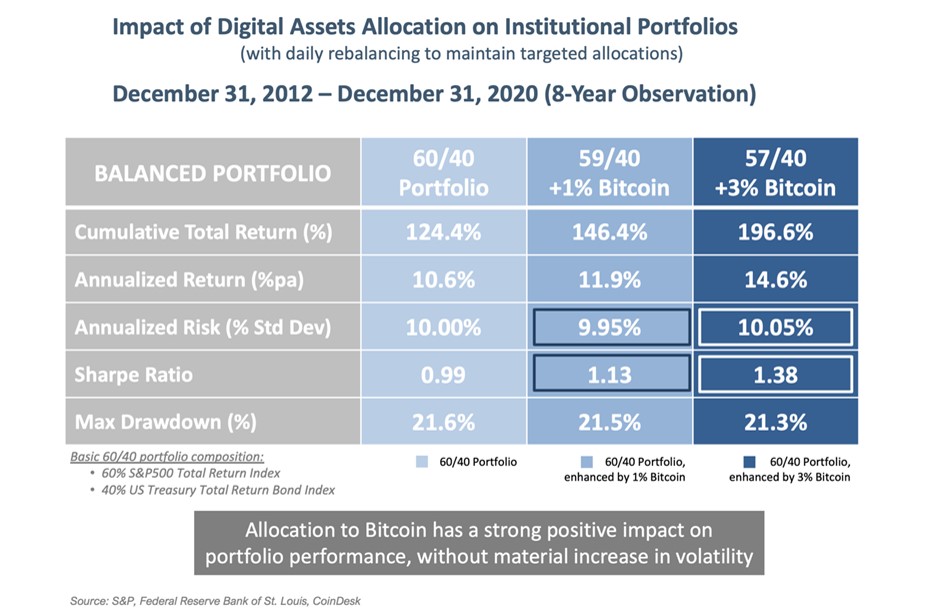

The firm said that having a small allocation to bitcoin – such as

1 per cent – has a positive effect. Its analysis found that

between 31 December 2012 and 31 December 2020, a portfolio of 60

per cent equities, 40 per cent Treasuries would have delivered a

124 per cent total return with a standard deviation of 10.0 per

cent. Adding 1 per cent of bitcoin to that portfolio would have

improved the return to 146 per cent, with a slight decline in

realised volatility, benefiting from bitcoin’s qualities as an

uncorrelated asset. Further, Nickel’s analysis said that if the

allocation to bitcoin had been 3 per cent, the cumulative total

return would have been 196 per cent.

“Because of its [bitcoin’s] considerable upside potential for the

next few years, it can significantly boost portfolio returns for

limited downside risk. However, if allocations on percentage

terms get much bigger, it exposes portfolios under risk of large

swings. Nickel would not recommend that,” Crachilov

said.

Crachilov brings plenty of financial sector experience to the

table. He has worked in the investment industry in various fields

for 25 years. Prior to Nickel, he worked for seven years for

Goldman Sachs and JP Morgan. He began to explore blockchain

technology and associated digital asset market because when he

was at Goldmans, clients were coming to the firm expressing

interest in exploring digital assets. Crachilov said he was among

the first global cohort of investment professionals to attend the

Oxford Blockchain Strategy Programme at the Saïd Business School,

Oxford in early 2018.

Crachilov said he decided to set up a full-service asset

management house dedicated to digital assets, working with

Michael Hall (who has had over 20 years of experience in running

market neutral arbitrage on fixed income and lately arbitrage of

digital assets) and Alek Kloda, who has a strong academic

background in maths and econometrical economics, etc.

The firm has three funds: Market-Neutral Arbitrage Fund; Digital

Gold Institutional Fund, and Nickel Digital Factors Fund. The

latest - Digital Factors - was launched in December 2020 and so

far only uses the partners’ money; the fund’s investment thesis

and risk management systems are being tested before external

capital Is allowed to come in.

Limited supply

At the moment there are 18.5 million bitcoins in circulation, or

88 per cent of the total finite supply, which is capped at 21

million on the protocol level. “The remaining 12 per cent will be

issued over the next 120 years with the last coin coming into

circulation in the year 2140,” Crachilov said, referring to the

hardcoded and pre-determined issuance schedule of bitcoin. “It is

this transparent and strict monetary policy which attracts

increasing attention of investors seeking a refuge from loose

monetary policies of central banks around the

world.”

There is a need to distinguish between bitcoin as a medium of

exchange and store of value. In the former, it is not very

efficient. Instead, it will be used as a reserve asset by clients

and instruments will be based on it, rather like banks issuing

bank notes backed by gold, he said.

Because of inelastic supply models, and rapidly rising demand,

coupled with a still-young market infrastructure and retail base,

prices will remain volatile for a while. The market is relatively

small at about $500 billion, dwarfed by the $10 trillion gold

sector and $80 trillion equity area, Crachilov said.

“As the market matures volatility will fall,” he said.

Custody

One headache for bitcoin has been custody, given potential loss

of asset and high-profile stories about thefts and hacking

attacks. Last month one story made the rounds about a German-born

programmer Stefan Thomas who lost access to his bitcoin stash,

worth $220 million, after losing his password. That’s the kind of

story to give bitcoin holders sleepless nights.

Crachilov said one option is the “hot wallet,” which is a

provision for users to temporarily store private keys (eg the

password to the asset) while using an exchange, or the “cold

wallet,” a self-custody solution, where the private key remains

in the investor’s hands via a specialised private key storage

device (example: Trezor or Ledger). However, even the latter

model would not be acceptable for the fiduciary management, as

the holder of the device remains a single-point-of-failure. Hence

the need for institutional-grade third-party custodians, he said.

There is a gap in the market for secure approaches to

custody.

“We have engaged third-party custodians to deal with the problem

of a single point of failure,” he said.