Alt Investments

Cannabis Investments: Will They Go Up In Smoke Or Generate Mind-Blowing Returns?

This article examines whether there is a place for one of the US' largest cash crops in a high net worth investor's portfolio.

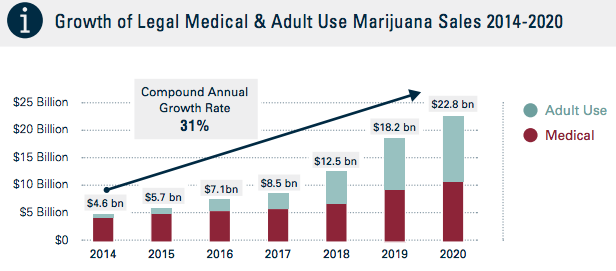

The cannabis industry in the US and Canada is booming.

Last year, legal marijuana sales across North America totalled

$7.1 billion as the industry grew by an unprecedented 30 per cent

year-on-year, according to a report by Arcview Market

Research.

And sales across the States and Canada are forecasted to top a

staggering $22 billion by 2021, assuming a compound annual growth

rate of at least 25 per cent.

(Source: Arcview)

While recreational and medical cannabis use is legal in just

eight US states, Canada has fully legalized the plant for medical

purposes across the country and is now edging towards

recreational legalization, which is expected to take effect on or

before July 1, 2018 and will make it the first G7 country to do

so.

.png)

This means that in less than a year, adult Canadian citizens will

be able to order cannabis products online from certified sellers

and have them delivered to their doors via Canada Post.

Couple this prospect with sky-high growth projections exceeding

200 per cent over a four-year period, and a savvy investor might

see a cash cow waiting to be milked.

So why are so many still afraid that investments in the sector

will go up in smoke?

Family Wealth Report recently spoke to Aaron Salz, a

former cannabis analyst and founder and chief executive of

Stoic

Advisory, a Toronto-based cannabis consultancy firm, to

discuss why one of the US' biggest cash crops belongs in every

high net worth investor's portfolio.

“Cannabis investing is a truly unique opportunity we haven't seen

in a long, long time,” Salz told this publication. “You're

looking at one of the highest growth industries we have seen in

well over a decade, one you probably haven't seen since the rise

of the internet. For that reason alone, I think it's an asset

class that deserves to be in everyone's portfolio.”

Despite the astonishing growth rate of the cannabis sector and

expectations for this to skyrocket, the plant is still illegal at

the Federal level in the US, and this is one major reason

mainstream investing in the sector is yet to take off, Salz

explained.

Social stigma

He added that social stigma is another deterrent, particularly

for the larger players such as big banks and institutional

investors. He suggested, however, family offices, high and

ultra-high net worth investors would be wise to “set aside their

morals and stigma and see it for what it is: a high-growth asset

class”.

“If you look at most of the major funds in Canada and the five

largest banks, they even still stay away from [investing in]

gambling,” Salz said. “I think, for now, we're fighting a social

stigma more than we are fighting regulation, but I think over

time this will be removed or at least change.”

In US, there are very few cannabis stocks listed on legitimate

exchanges because of its legal status at the Federal level.

Instead, they are usually listed on pink sheets and

over-the-counter markets, where there is little concern over a

company's business providing it files the required paperwork.

This “inherently makes them volatile penny stocks,” Salz

said.

In Canada, however, it is a different story, as many cannabis

companies are listed on the Toronto Stock Exchange, considered by

many as one of the world's top-five exchanges, granting them

access to legitimate capital.

But just because a company is listed on a legitimate stock

exchange does not mean it is completely clean.

“One of the main challenges, from a business perspective, is that

the cannabis industry is facing something akin to a pesticide

crisis,” Matt Mauer, an associate from law firm Minden Gross and chair

of its cannabis law group, told this publication. “Last year,

several companies were found to have used banned pesticide

products, which doesn't help the industry's image in general.

This erodes public trust, and dealing with that is one of the big

challenges.”

However, cannabis companies straying from the rules is not the

main deterrent, Mauer claims, as wrong valuations could be giving

investors cold feet.

“If anything, it's the notion that these companies are currently

overvalued,” Mauer said. “Some say companies' financials don't

add up with their valuations.”

This, among other reasons, is why consultant Salz - who also

spent a stint investing in cannabis stocks on behalf of Canada's

Interward family office - expects cannabis stocks to be

considered a high-growth, speculative asset class for the next

five to 10 years.

He claimed this will change if and when cannabis is Federally

legalized in the US because this will spur institutional

investors to pour money into companies they consider

“legitimate”, in turn allowing the industry to mature.

“For [cannabis stocks] to take off as a blue chip asset class it

will have to be Federally legal in the US,” Salz said. “From a

stigma point of view, once cannabis consumption becomes no

different to alcohol, I think the asset class will legitimize.

The industry is still in this nascent stage as there are

thousands of brands and companies. It needs to mature and

consolidate so there are major players, companies moving from

hyper growth to stable growth, and blue chip management.”

He continued: “Institutional investors want to invest in blue

chip companies capable of paying dividends to shareholders.

Institutional investment leads to stability. I think that will be

critically important for [cannabis] becoming a reputable

industry.”

At present, the largest cannabis stock is GW Pharmaceuticals, a

biopharmaceutical company that develops and commercializes

therapeutics using a proprietary cannabinoid product platform.

Listed on NASDAQ, its market capitalization is $2.87 billion.

Still, setting up shop in the cannabis space is not for the feint

hearted, Mauer said, explaining that initial costs for a grow run

into “at least millions of dollars”, sometimes as high as between

$8 million and $10 million once a full licence is obtained. This

can take up to 30 months, he said.

Mauer said that once marijuana is recreationally legal in Canada,

the government will look to ease the licensing process for

smaller growers, which would make the market more accessible to

new players. As new players enter the ring, undoubtedly so will

new opportunities.

Cannabis In high net worth portfolios

Salz suggested that cannabis-related assets could comprise part

of high and ultra-high net worth investors' portfolios, even they

are nearing the end of their wealth cycle, as he believes “later

in life when preserving wealth, between five and 10 percent of a

portfolio should be dedicated to higher risk, speculative asset

classes”.

Mauer also reserves a seat for high-growth cannabis

equities.

He said: “It's like an explosion. Everyone and their dog has an

idea they want to bring to the market. The industry is growing

exponentially and it seems like, at least for the short term,

there is no end in sight.

“Canadian companies are already looking beyond Canada's borders

to diversify and grow. What started as 'we make this amount of

weed for X and sell it for Y and keep the profits' has opened up

unlimited avenues.”

He continued: “[Certain] cannabis companies are now financing

smaller ones in exchange for revenues down the road; they're

buying real estate; they're buying technology operations. Things

are moving very quickly.”

He warned, though, that investors must take caution and ensure

they “carry out proper due diligence on cannabis companies as

there are still some bad actors operating”.