Emerging Markets

Barings Stays Constructive Over Emerging Debt

.jpg)

What are the prospects of emerging market debt? With all the volatility and shifts around what might happen to global interest rates, Barings, the asset management house, considers the terrain.

Investors in emerging market debt have had a great deal to think

about recently, particularly given the ratcheting up of

protectionist talk – and possible action – from US President

Donald Trump and his counterparts in China. Emerging markets are

clearly concerned about any row-back from globalization, even if

such fears are overblown. At the same time there remains

speculation on how quickly central banks, notably the US Federal

Reserve, will return to some form of “normality” in interest

rates.

The first quarter of 2018 has been anything other than dull for emerging market investors and the team at Baring Asset Management takes a step back to consider developments and possible next steps. The editors of this news service are pleased to share these views; they don’t necessarily endorse all view of guest contributors. Readers can respond by emailing tom.burroughes@wealthbriefing.com

The first quarter of 2018 was mixed for emerging markets (EM) debt, with EM local debt returning 4.42 per cent, EM corporates returning -1.12 per cent and EM sovereigns returning -1.74 per cent. EM local was supported by higher Brent crude oil, rising commodity prices, favorable political dynamics in South Africa and positive commentary regarding NAFTA negotiations. Hard currency assets were negatively affected by higher US Treasury rates and minor spread widening. During the quarter, EM debt funds experienced $20.9 billion of inflows, with 50 per cent going into EM local funds. This is the strongest annual start for emerging market local in the past five years. (1).

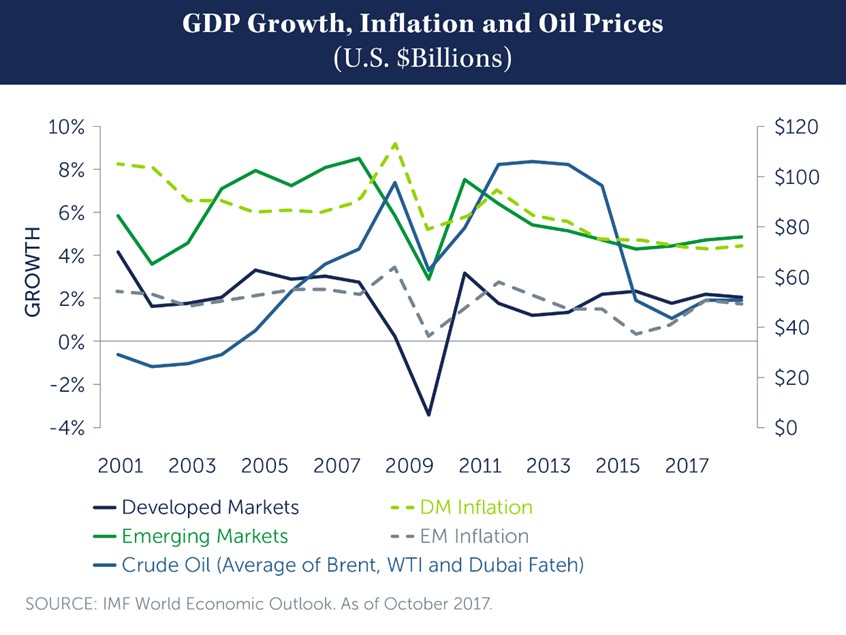

Global growth has continued to improve, as ongoing economic adjustments in both developed markets and emerging markets have resulted in stronger consumption. The only region that experienced lower export volumes in 2017 was Africa and the Middle East. However, following recent reforms, the region is expected to grow in 2018. Global GDP was up approximately 3.6 per cent in 2017 and is projected to grow by 3.7 per cent in 2018, with the World Bank expecting emerging markets to lead the way with 4.5 per cent growth. Emerging markets inflation is now at a 17-year low, despite higher energy prices and moderate economic growth. As discussed in our recent viewpoint, this provides a strong backdrop for EM local rates to potentially continue to come down in select countries over the next 12 to 18 months. (2)

Emerging markets experienced their fair share of headlines during the quarter. In South Africa, following Cyril Ramaphosa’s December win to lead the African National Congress in the 2019 presidential election, former President Jacob Zuma resigned, paving the way for Ramaphosa to be the current and future leader of South Africa. Russia’s sovereign debt rating was upgraded to investment grade, as the country has successfully responded to lower oil prices and international sanctions. On the other hand, Brazil’s credit rating was lowered further into junk territory by Fitch. The country has continued to run “persistent and large fiscal deficits and a higher and growing government debt burden (local debt)”, and the government has failed to implement reforms that would improve the structural performance of public finances.

Corporate earnings have continued to be largely positive, while sovereign and corporate default rates remain below historical averages. In terms of global monetary policy, the US Federal Reserve has raised interest rates by 0.25 per cent, the European Central Bank remained on hold (and indicated it may end its bond purchasing programme in September 2018), and the Bank of Japan has remained accommodative. While higher rates in the US may be challenging to some sovereigns and corporates, overall stronger developed market growth should provide for a mostly positive backdrop for emerging markets going forward, in our view.

Outlook

Global growth has continued to improve, as economies have adjusted and consumption in both developed markets and emerging markets has accelerated. We expect continued improvement in global GDP in 2018, with EM likely leading the way. Balance of payments and current accounts across EM countries have continued to improve. Many economies have made substantial fiscal adjustments given the lower commodity prices, prudent monetary policies and, in some cases, increased tax collection. Stronger growth and significantly lower funding needs, coupled with flows and foreign direct investment (FDI) into stronger countries, will likely remain supportive of currencies and hard currency bonds.

Company fundamentals have improved on the back of economic growth and higher commodity prices, while corporate leverage is expected to decline. These positive trends may translate into ratings upgrades over the next 12 to 18 months.

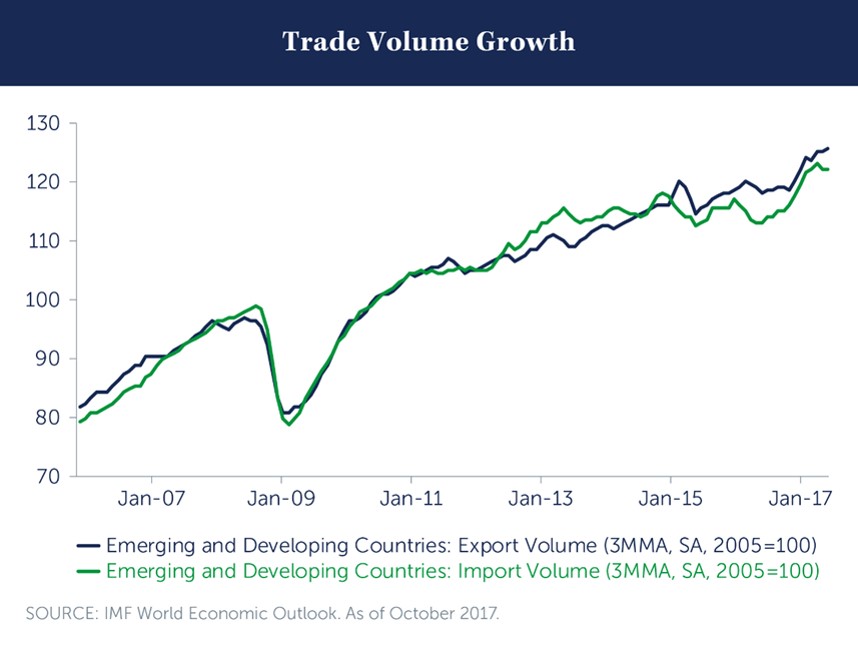

Global trade volumes have continued to show signs of recovery - a trend we expect to continue in the months ahead, potentially providing a positive catalyst for commodity exporters. Country and credit selection will likely continue to be crucial in the year ahead due to a heavy election calendar, geopolitical risks and less spread differentiation between higher- and lower-quality credits.

We continue to take a constructive view of EM debt as a whole and expect particularly healthy returns from EM local debt due to moderate growth, lower inflation and continued fiscal adjustments across many countries. Although sovereign hard currency has tightened significantly, we see select opportunities where spreads continue to overcompensate for defaults, in our judgment.