Strategy

Aussie Rules - Competing For The Grey Pound

Which countries are attracting wealthy retirees and where should money managers put their focus? The UK Department for Work and Pensions has some answers.

Each year the UK Department for Work and Pensions (DWP) produces a list of where roughly 1.2 million retired British expats are drawing their state pension. Australia took the top spot in 2018, with around 20 per cent (235,000) claiming their state pensions from there. The US and Canada came in second and third with 134,000 and 133,000 retirees respectively, and Ireland and Spain rounded out the top five.

The list is a good barometer for wealth managers and financial planners looking to build offerings in favourable retirement spots and capture grey-pound investment opportunities. It is also a useful comparison tool to see what destinations are moving up the ranks and falling out of favour as an aging population grapples with retirement decisions. And many more of these decisions will be made in coming decades.

Figures from the Institute for Public Policy Research show that between 2016 and 2030, the UK’s over 65s population will grow by 33 per cent, and by 2045 will account for a quarter of the population.

Although southern European countries such as France and Spain have traditionally been retirement hotspots, the latest pensions data shows that around 45 per cent of claimants are choosing non-EU destinations that are English-speaking and further afield. It is too early to tell how EU member countries will fare longer term in attracting wealthy British retirees as the UK’s terms for leaving the union are anything but clear.

The government department issuing the data clarified to this publication that the claimants are not necessarily British expats, but anyone who has worked in Britain and is eligible to receive a UK state pension.

In the case of Australia, which has strong historical and cultural ties to Britain, those numbers will be inflated by antipodeans returning home after establishing careers in the UK. Diaspora relationships and a generally fluid labour market will also account for Ireland featuring so prominently.

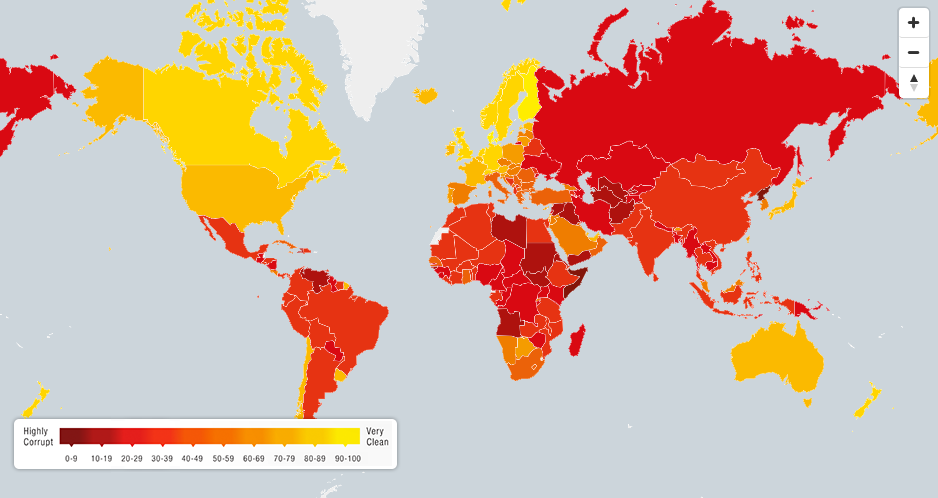

That said, countries like Australia and New Zealand regularly appear on “best places to retire” lists because they offer a sweet spot of agreeable climate and lifestyle attractions plus, crucially, good public health services, infrastructure, political stability and language compatibility.

Andrew de Candole, CEO at easyMoney, a finance platform that offers retirement plans secured against UK property, said, “Spending your golden years abroad is an attractive option for many but it does rely on having a sizeable private pension pot.”

The platform has used the list to advise that building private pension means alongside any state allowance is key to meeting the costs associated with relocating, including housing, living, healthcare and insurance.

.jpg)

Source: easyMoney

An estimated 244 million expats live globally, which equates to the fifth largest country in the world according to Expatland, an international service provider helping expats relocate and settle abroad.

Back in November, this publication wrote about the group’s partnership with UK wealth manager St. James’s Place to better serve Asia’s growing expat communities and provide a host of financial services beyond the initial relocation support.

John Marcarian, the Australian tax specialist and founder of Expatland, calls the coveted community “the 3 per cent changing the world” and says membership for the service is growing by 300,000 a month.