Legal

August Big Read: LPAs, Capacity And Silver Splitters - The Practitioner’s Perspective

.jpg)

Here is another examination of government proposals to reform the LPA system and bring it into the digital age.

In July the UK government announced proposals to make the system of lasting powers of attorney more up to date by encouraging a more digital approach, for example. We have already carried a commentary on the topic here. In this article, a practitioner working in the space examines the terrain. The authors are Leora Taratula Lyons and Peter Burgess, Burgess Mee Family Law. The editors of this news service are pleased to share these insights and invite responses. Email the editors at tom.burroughes@wealthbriefing.com and jackie.bennion@clearviewpublishing.com. The usual editorial disclaimers apply to the views of guest contributors.

Last month, the Ministry of Justice announced a consultation on

making Lasting Powers of Attorney or LPAs “safer, simpler and fit

for the future.” The focus is on improving the process of making

and registering LPAs, potentially by using developments in

technology and balancing this by ensuring that sufficient

safeguards are in place to protect the donor (the person making

the LPA) from fraud.

Although LPAs were introduced almost 15 years ago, the archaic

and laborious process of signing and registering these important

forms retained many of the hallmarks of its predecessor, the

Enduring Power of Attorney or “EPA,” which was established back

in 1985. As the consultation’s foreword describes, the LPA is

“[i]n its essence, […] 36 years old.” Despite the initial form

filling part of the procedure being digitised, the stages that

follow require printing and signing the hard copy pages in the

correct order by the correct party in wet ink. This is proving

increasingly difficult due to a growing number of international

families with social distancing measures preventing parties from

gathering together to sign documents, resulting in sending the

forms from person to person in turn - an unnecessarily

time-consuming and convoluted process.

The growth in LPAs being registered

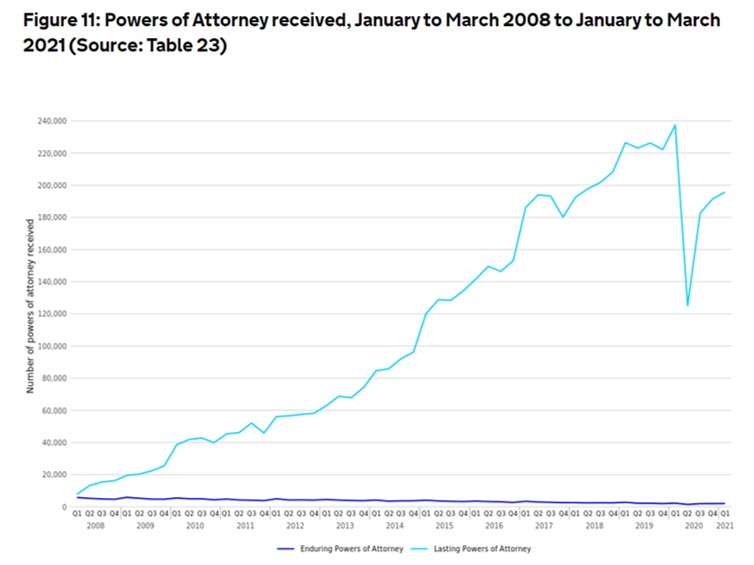

Statistics since 2008 show an exponential rise in the number of

applications for LPAs being registered with the Office of the

Public Guardian. The graph (1) depicts a huge upward trend from

roughly 10,000 in 2008 to a peak of 240,000 in Q2 of 2020.

COVID-19 caused a significant drop in Q3 of 2020 (down to approx.

125,000) before the figures rebounded and now sit at around

200,000 per quarter. The Ministry of Justice attributes the very

sharp rise in 2015 and 2016 to increased publicity about the new

online forms introduced at the time, making it simpler and faster

to apply.

The impact on family law

Why is this significant? It’s down to the increasingly common

phenomenon of “silver splitters” i.e. those who divorce and

separate later in life.

As a solicitor advising a new client facing a pending separation

or divorce, we would usually float the idea of a change to their

will, or making an LPA, as well as considering “severing” the

title to any jointly-held property so that it passes in

accordance with their will, rather than to the surviving joint

tenant. Clients may prefer not to take up this option as

naturally it works the other way i.e. if they sever the tenancy

and the other party dies, they will not automatically inherit as

a joint tenant. However, as clients are getting divorced and

separating later in life, issues around inheritance and capacity

will increasingly feature in future.

In our 16+ years of private practice, issues of capacity have

become far more prevalent with overlapping applications in the

Court of Protection, and more frequent recourse to mental health

assessments. As public awareness of mental health issues has

grown, assessments have become more common in family law,

encompassing children work and increasingly financial remedy

work, in the context of decision-making capacity.

Practice Direction 15B of the Family Procedure Rules deals with

what the court will do when an adult may be a protected party. It

is the responsibility of the solicitor acting for the client in

the first instance to assess capacity and it is one of the few

areas of the Family Procedural Rules where a solely-appointed

expert is recommended. Under the Mental Capacity Act 2005,

capacity is presumed, and this applies here as well. It is also

important for the practitioner dealing with the matter to

consider what level of understanding the party needs to have

capacity to make decisions. The capacity to get divorced, for

example, may be different from the capacity to litigate a

financial remedy case. The practitioner may also need to consider

their client’s ability to give evidence as a witness.

In these cases it may be necessary to appoint a Litigation Friend

to stand in the shoes of the protected party and make decisions

on their behalf. This could be another family member, or a

professional Litigation Friend. It is possible in this situation

to involve the Official Solicitor, but usually only as a last

resort.

The views of family members are significant and the extent to

which they may align with those of the protected party. Depending

on their level of awareness, a proof of evidence may be taken

from the protected party or their views elicited in order for the

Litigation Friend to make an informed decision on that party’s

behalf.

One case on which we were instructed involved parties in their

90s getting divorced. The children of these parties were divided

on either side by gender. The husband was alleging that both the

LPA and divorce petition were made at a time when his wife lacked

capacity to do so and further that the wife had been subject to

undue influence by one or more of the children. There were

concurrent Court of Protection and Family Division proceedings

being overseen by a High Court judge (who could sit across both

cases). A number of experts were appointed to give evidence about

the lay client’s ability to make decisions at that

time.

In such situations, the views of the adult children and their

competing interests are likely to play a part in resolving any

dispute. It may be an idea to consider a civil-style mediation

with all parties represented including any interested family

members. In this case it was possible to resolve the issues,

including questions of inheritance, without the need for a

contested hearing although, had it been heard, it would

undoubtedly have been a reported decision on the capacity

required to get divorced and of general application to family law

practitioners. Practitioners should also be mindful of the risk

of both undue influence and fraud, which will be a focus of the

potential future reforms to the LPA process.

As medical science and our understanding of physical and mental

impairment advances, so the family law scenarios in which such

assessments may be relevant, increase.

For clients in the later stages of life, it may be sensible to

look at preparing LPAs and a new will with the backing of a

capacity report from a specialist neuropsychiatrist or GP at the

time those documents are executed in order to insulate them from

a later challenge by another family member (also known as

adhering to the “Golden Rule” in respect of the execution of

wills).

If a diagnosis of a degenerative illness is made which might

affect mental capacity, it is sensible to get some guidance from

a treating clinician about the effect of any impairment in order

to advise the client about when to enter into a new will or LPA.

Broad questions about the status of their marriage and the

arrangements in place on the ground should be asked so that an

assessment can be made as to whether, for example, a postnuptial

agreement should be entered into. Like a prenup, this contract,

whilst not automatically binding, would be an effective means of

asset protection in the event of the death of the

patient/spouse/cohabitant and would avoid a disputed inheritance

claim which might follow.

We fully expect there to be more cases involving crossover

between the Family Court and Court of Protection and it is

important for all advisors (whether lawyer, accountant, financial

planner, investment manager or trustee) to recognise the likely

interplay. For family lawyers in particular this means

understanding LPAs and capacity, and for private client lawyers,

this means understanding how a will or LPA might be challenged

and its impact on separations later in life.

Footnote

1, See ‘Figure 11: Powers of Attorney received, January to March 2008 to January to March 2021 (Source: Table 23)’ figure 11 at Section 13 Mental Capacity Act - Office of the Public Guardian: https://www.gov.uk/government/statistics/family-court-statistics-quarterly-january-to-march-2021/family-court-statistics-quarterly-january-to-march-2021

Burgess Mee Family Law is a specialist family law boutique practice with offices in South, West and North London.