WM Market Reports

America Retains Top Global Wealth Spot; Asia Has Big Momentum - BCG

Among the report's findings was that Switzerland is still Number 1 as a cross-border wealth destination, Asia is poised to overtake Western Europe for wealth scale, and the medium-term story remains a growth one.

Asia will leapfrog Western Europe to be the second-biggest wealth

market in 2022 if current growth rates endure, while North

America will stay top of the hill, according to the 20th edition

of the annual Boston

Consulting Group report on the sector.

BCG, looking back over the past two decades, noted that the

underlying story – despite preoccupations with COVID-19 – is a

vast increase in wealth and the ascent of emerging market

countries, with Asia leading the charge. Personal financial

wealth stood at $226.4 trillion at the end of last year, rising

from $80.5 trillion at end-1999.

That shift explains why wealth management - private banks,

family offices, advisors, trust companies and other entities

- have been on a rising escalator, becoming more visible

parts of the financial sector. Once relatively obscure and not

widely reported on, the sector is more likely to make the news

front pages. The rise in wealth has also put certain financial

hubs in the limelight, including those under the “offshore” tag,

such as Switzerland, the Channel Islands, Singapore and Hong

Kong.

Emerging, younger economies have grown rapidly over the past 20

years, taking a larger chunk of the global total. In 1999, for

example, Asia and other growth regions accounted for 9.3 per cent

of global wealth. By 2009, that share had jumped to 17.3 per

cent; and by the end of 2019, it had grown to 25.3 per cent of

global wealth.

Greater economic attainment has enlarged the ranks of the world’s

wealthy. The number of millionaires (in US dollars) globally has

nearly tripled in the past 20 years, from 8.9 million in 1999 to

more than 24 million by the end of 2019. Collectively,

millionaires now hold more than 50 per cent of total financial

wealth globally (calculated on the basis of nominal growth rates

and not taking into account inflation effects).

North America still rules – for now

North America continues to have the largest number of

millionaires (16.4 million) - more than half of whom (10.3

million) became millionaires during the 21st century. North

America is also home to the greatest concentration of high net

worth (HNW) individuals. This segment now accounts for 59 per

cent of the wealth in North America ($59 trillion).

Asset allocations contributed to different rates of wealth growth

across segments over the past ten years. The HNW segment and the

ultra HNW (UHNW) segment - individuals with a total financial

wealth of more than $100 million - prospered the most. Because

their portfolios comprised a much higher share of equities than

other wealth bands (more than 50 per cent are invested in

equities and investment fund shares, on average), they were well

positioned to reap the gains from the recent long bull

market.

By contrast, the retail segment – individuals with assets of less

than $250,000 - invested, on average, only about 9 per cent of

their assets in equities and investment funds, with more than 80

per cent going instead into cash and deposits and life insurance

and pensions. That low rate of investment translated into lower

rates of wealth growth for this segment.

Future

BCG said that its models suggest that wealth across Asia,

excluding Japan, will grow at between 5.1 per cent and 7.4 per

cent annually over the next five years. “Should that forecast

hold, Asia will overtake Western Europe as the second wealthiest

region in the world by 2022. Wealth in North America, which is

more heavily weighted toward equities, could grow at –0.6 per

cent to 3.7 per cent annually from 2019 to 2024, depending on how

severely the COVID-19 crisis damages the global economy,” the

report said.

For Western Europe, BCG projects a steadier growth range of

wealth growth of about 1.6 per cent to 3.6 per cent, given the

region’s heavier weighting toward cash and deposits, which are

less volatile than equities. Because average GDP in the region

over the next five years is expected to be lower than the average

for the past 20 years, wealth growth in the region is unlikely to

eclipse that of North America, it said.

BCG predicts that HNW and UHNW populations will remain the

fastest growing segments in North America and that the affluent

band will be the fastest-growing segment in Asia, Western Europe,

and the Middle East. In Asia, affluent individuals will see their

wealth rise by a compound annual growth rate of 6.0 per cent to

8.7 per cent over the next five years (totaling from $5.7

trillion to $6.5 trillion by 2024).

Cross-border, geopolitical angst

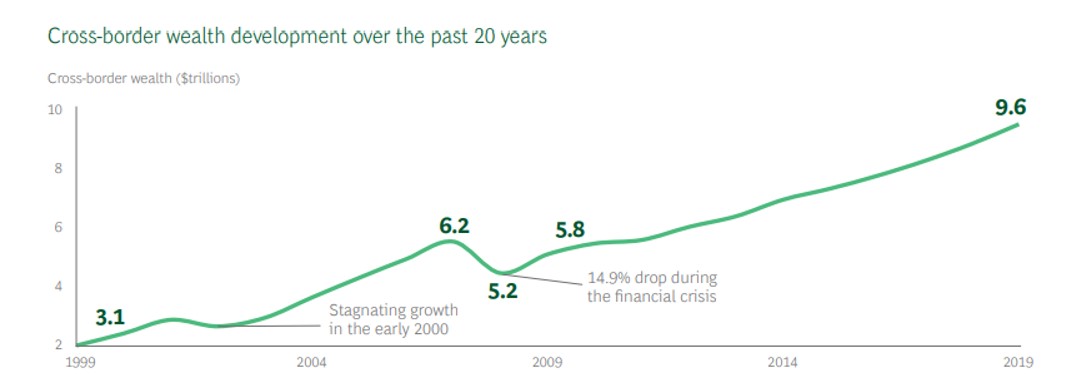

Cross-border wealth surged over the past 20 years, growing from

$3.1 trillion in 1999 to $9.6 trillion in 2019.

“Past crises have usually led to a short-term increase in

cross-border capital flows. Whether the COVID-19 pandemic will

lead to a similar shift depends on how severely the fallout

impacts business liquidity, whether certain markets suffer

economic and political instability, and whether governments enact

stiffer tax measures to cover the costs of their crisis

interventions.

The report’s authors think that as a result of instability and

political worries, investors are likely to consider moving assets

to perceived safe havens. Despite such inflows, cross-border

wealth will fall by 5.4 per cent to 10.2 per cent in 2020, driven

by the performance of the capital markets.

Over the medium term (2021 to 2024), investors may look to

repatriate assets to make it easier to get their hands on money,

especially if the economic downturn follows a “lasting-damage

scenario”, the report said.

“Regional cross-border wealth patterns are changing as well. In

1999, for example, Western Europe represented almost 50 per cent

of all cross-border wealth globally. As of 2019, that share had

declined to 24 per cent and will drop slightly below 20 per cent

by 2024. By contrast, Asia’s share of cross-border wealth is set

to reach 40 per cent by 2024. The Middle East and Latin America

are also expected to see their share of cross-border wealth grow

slightly faster than the global average over the next five

years.

The BCG report noted that Switzerland remains top of the

cross-border tree, holding $2.4 trillion of such money in 2019,

ahead of Hong Kong at $1.9 trillion; Singapore at $1.1 trillion;

the US at $800 billion (Delaware structures, etc); the Channel

Islands ($500 billion); the United Arab Emirates ($500 billion);

Luxembourg and the UK both at $300 billion.

“From a booking center perspective, Switzerland remains the

largest destination, accounting for approximately one quarter of

global cross border wealth. Hong Kong is catching up, however, as

a result of rapid growth in assets from wealthy individuals in

China and other parts of Asia. These individuals currently

account for 17 per cent of global cross-border wealth. Singapore

is the third-largest hub for cross-border wealth, with total

bookings in 2019 exceeding $1 trillion,” the report

said.

Singapore is also likely to benefit from the continuing influx of

Chinese wealth. While the protests in Hong Kong that began in

2019 have had no significant effect on cross-border assets so

far, ongoing turbulence could encourage wealth flows to shift

toward Singapore and other cross-border centers,” it added.