Just under a fifth of 520 directors of UK-owned businesses said they intend to pass their companies to children within the next five years partly because the government is cutting reliefs on inheritance tax (IHT), a survey of owner managers says.

, an accountancy firm and business advisory network, said that 19 per cent of business owners intend to make the move.

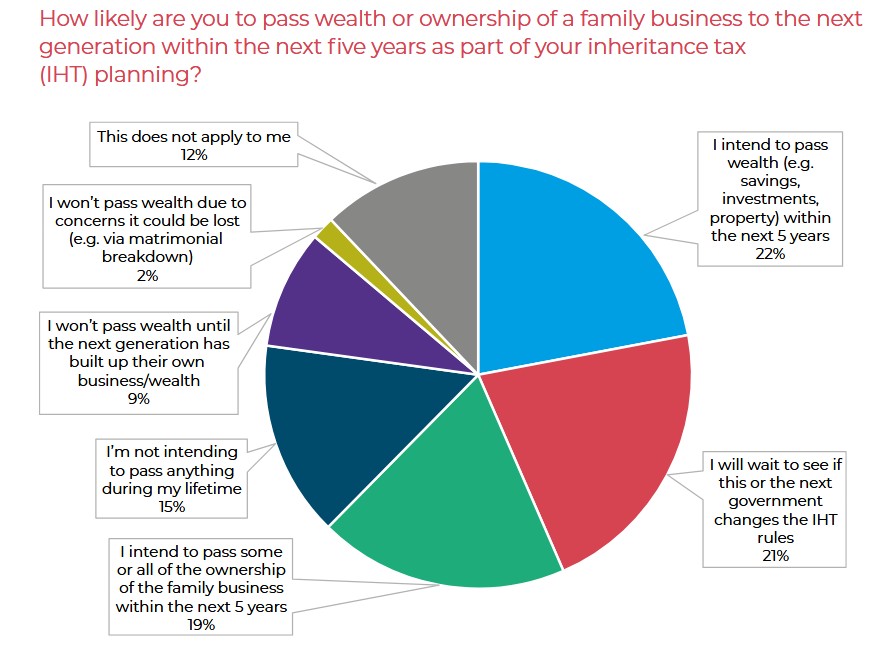

Besides those who said they'd pass their family business on, 12 per cent said they aren't affected by the IHT issue; 2 per cent said they won't pass wealth on because they worry it could be lost (such as because of divorce); 22 per cent they will pass wealth - savings, property and investments, in the next five years; 9 per cent won't do so until the next generation has created its own business; 15 per cent said they did not intend to pass anything on during their lifetime, and 21 per cent said they will wait to see if this or the next government changes IHT rules.

Source: Moore UK Owner-managed business survey: The confidence gap: why businesses are holding back on investment

On 23 December 2025 the government said IHT would be payable on the value of businesses above a £2.5 million ($1.86 million) threshold, effective 6 April 2026. Previously, the UK finance minister Rachel Reeves had set the threshold at £1 million – a decision that prompted anger from businesses such as family farmers. Prior to the change, business property, including farms, were exempt from IHT. Reeves said the change was needed to help plug a large "black hole" in public finances. Critics say the damage to the UK family-run business sector outweighs any likely revenue gains. As IHT thresholds on the general population have held unchanged for years, the "fiscal drag" effect has drawn in more revenue, as figures issued late last year showed.

A rush to transfer businesses to heirs could backfire if inheritors are not ready to manage them, Mark Lance, Moore UK chief executive said.

“There is a serious risk that business owners are being forced into these transfers by the changes to IHT to the potential detriment on those businesses. Having these very experienced business owners suddenly step away from the management of these businesses has clear disadvantages,” he said.

Moore’s survey found that 23 per cent of business owners with revenues of £5 to £10 million intend to transfer all or part of their wealth within the next five years, making them the most likely to do so. Those with incomes of £2.5 to £5 million were the least likely to do the same, with just 13 per cent planning to transfer their companies.

“Traditionally, business owners would pass on wealth once they died. However, due to a change in policy introduced by the government, they are now seriously considering transferring that wealth within the next five years. Taxation continues to dominate the concerns of business owners. As we look towards 2026 it stands out as the single greatest challenge cited by 40 per cent of respondents,” Lance said.

Moore UK found that the wealthier a business owner is, the more likely they are to pass it on to their children within the next five years. It said that 18 per cent of owners whose businesses have revenues of £1 to £2.5 million plan to pass along wealth, including property, savings and investments, to their children. That rises to a third, for those with revenues of £20 to £30 million. On average, 22 per cent of business owners plan to pass on some of their wealth.

In a finding that adds to concerns that affluent UK citizens are contemplating leaving the country, the survey found that 45 per cent of business owners said they would consider leaving the UK due to the tax rules. Some 18 per cent said they would leave to save income tax; 12 per cent would depart for a country with a better environment for business growth.

(See related commentary on IHT here.)