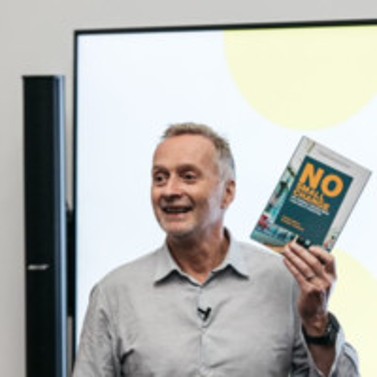

Banking entrepreneur and business founder Anthony Thomson (pictured below) – creator of the UK’s Metro Bank among others – has broken fresh ground with Bank Velorai.

Anthony Thomson

The new organisation is designed to serve and be built by family offices and ultra-high net worth clients. It is in the licensing process with the . The bank aims to begin operations following licence approval, with its launch planned for late 2026.

And just as lenders such as Metro were designed to challenge traditional ways of operating, Thomson and his cohort of founders want to change the game of how family offices are served.

The name is deriived from the Latin word Velora, meaning “strength and courage,” and AI as in “intelligence and foresight,” reflecting both the bank’s digital foundation and its commitment to long-term vision.

In the days leading up to the launch announcement, Thomson told WealthBriefing why he thinks family offices need this kind of bank.

“Conventional banks struggle to service the complexity and cross-border nature of family office structures. It’s not that they want to serve FOs poorly; it’s that they were never designed to serve them well. The systems, incentives and structures in place make truly client-first service difficult,” he said.

“For example, a family might have assets and entities spread across several jurisdictions, but existing banks treat each relationship separately. Our model is built to recognise and service the family as a whole – integrating those relationships into a single view and providing flexibility in how assets are accessed,” he said.

The new bank will focus on lending, mortgages, deposits, unsecured, Lombard and margin lending, he said.

Bank Velorai is initially raising $100 million in capital. “We have a number of family offices that want to be early investors,” Thomson said. “Our intention is that shareholdings will be evergreen.”

However, once the bank is up and running and profitable, shareholders will be asked whether they are interested in a limited free-float IPO. A family office ownership model makes the venture unique, Thomson said.

How it started

Thomson started to research the area in 2025, and began by asking family offices’ representatives two questions: “What do you like about your bank and what do you not like about your bank?” He had a total of 72 conversations.

“What people liked about their bank could be written on the back of a postage stamp,” Thomson said. “Their biggest complaint is that 'all my bank wants to do is sell me investment products’.”

Another complaint he heard was: “When I joined my bank it was on the understanding, I’d be getting great service and access to deal-flow…but often nothing happens.”

“Banks are,” Thomson said, “often failing to respond to the needs of family offices. Sometimes because of regulations…banks take weeks to approve relatively straightforward credit requests, such as Lombard loans.”

The founding team

The team involved in building this lender are Paul Pester, non-executive director, (chair of Tandem Bank, the digital bank, and chair of Firenze, and former CEO of TSB Banking Group and CEO of Virgin Money); Stuart Grimshaw, CEO (senior executive roles at ANZ Bank, National Australia Bank, Commonwealth Bank of Australia, and other organisations); Samantha Bamert, deputy CEO, chief commercial officer (founder of Ask Inclusive Finance, and former senior figure at Barclays Investment Bank and Barclays Wealth); Sudip Dasgupta, CTO (former CTO of Monument Bank, and CTO of Bank of London and The Middle East, and senior manager at Deloitte UK); Dr Glenn Leighton, CFO (he was MD of balance sheet advisory at Barclays and Lloyds Banking Group, and is also an authority on banking regulation); and Angus Gow, chief engineer, and technical architect (long-standing figure in banking technology, fintech and AI.)

Other figures in the line-up include Andrew Rufener, head of product; Stepan Boguslavsky, head of investor relations, Rebecca Bettany, NED, and Dato Paul Supramaniam, board advisor.

Thomson’s story

Thomson has been shaking up banking since 2007 when he founded and chaired Metro Bank, the first new bank to launch on British high streets in more than a hundred years. He went on to found and chair atom bank, which said it is the UK’s first mobile bank, and Australia’s first mobile challenger bank 86 400. He co-founded and chairs archie, a fintech accelerator supporting early-stage innovators. He is a former advisory board member at ila Bank (Bahrain and Jordan), iNED Wio Bank (UAE) and iNED agiliti, a Fiserv BaaS company.

Jurisdiction

Besides Jersey, this news service understands that the bank will also seek to have a branch in Singapore.

“Jersey will be the bank’s initial regulatory base, given its credibility, regulatory rigour and long-standing reputation in private wealth. Singapore has been identified as a key jurisdiction for client growth and regional presence, and we plan to establish operations there following launch,” he said.

WB asked about Bank Velorai’s revenue model.

“It earns income from core banking activities (deposits, lending, and transaction accounts) rather than selling investment or advisory products. By removing the traditional frictions between banks and clients, and by being majority-owned by the family offices it serves, it aligns value creation directly with client outcomes. The model prioritises long-term relationships, sustainable profitability, and exceptional, bespoke service over short-term thinking,” Thomson said.

“We’re building the bank from the ground up on a modern digital core, without the legacy systems that slow traditional institutions. Cutting edge AI-enabled onboarding and decision-making will reduce processes that currently take weeks to a matter of hours, while compliance remains fully transparent and robust,” he continued. “The bank’s technology platform is unique, utilising technology, so far unused in banking, that will enable us to offer better products, services and experiences to clients faster.”

“The efficiency enables us to reduce the cost/income ratio from the circa 63 per cent average of private banks today to around 20 per cent, which means better value for clients and better performance for shareholders,” he said. “However, technology will support, not replace, relationship management, freeing our time to focus on understanding the unique conditions of families rather than navigating bureaucracy.”

Booming sector

There are about 8,000 family offices globally, according to Deloitte. And Thomson sees the growth as a significant opportunity.

“The number of FOs globally has grown by more than 30 per cent in the past five years, with Asia now surpassing Europe in the rate of formation. We expect this momentum to continue as new wealth transitions to the next generation, who think in terms of purpose, technology and global reach,” he added.