The following article from BNY Investments, which examines the world’s credit market, argues that global credit should be a core part of a portfolio. The editors are pleased to share this material; the usual editorial disclaimers apply to views from outside contributors. To comment, email tom.burroughes@wealthbriefing.com and amanda.cheesley@clearviewpublishing.com

At BNY Investments, we believe that global credit is endowed with a number of favourable qualities, compared with other financial asset classes. It includes thousands of issuers with good credit quality, diversity and depth in the investable universe, and yield with the potential for income streams relative to history. In our view, these features create a compelling case for considering a core global credit allocation.

Let’s look at them in turn.

Investment grade at its core, worldwide in its spread

A global credit universe will typically consist of high-quality securities, across the investment grade spectrum, from the highest AAA rating, through to BBB-. The Bloomberg Global Agg Credit Index (the “Index”) is a common benchmark for global credit managers and, as of March 2025, contains more than 20,000 securities, from more than 2,600 issuers, demonstrating the breadth and depth potential opportunities within the market. Its geographical coverage ranges worldwide rather than being confined to single discrete markets. It consists of borrowers from around the developed and developing worlds and in a number of currencies, with the dollar being dominant.

Corporate issuers and more besides

The bulk of the global credit world is made up of issues from corporate borrowers, covering the breadth of the economic landscape. They range from industrial sectors to utilities and financials. Industrials include sectors such as automotives, pharmaceuticals, energy, telecoms, and technology, while financials capture sectors such as banks, insurers, and real estate investment trusts (REITs). Utilities are typically a smaller sector covering electricity and gas providers.

However, the credit universe is broader than the corporate universe as it also includes issues from a collective of government-related, or non-corporate, entities. In general, they have stronger average credit ratings than the corporate issues in the universe and come from four key sources.

Supranational entities, such as the European Investment Bank and International Bank for Reconstruction and Development, make up about a tenth of the Index and are mostly highly rated (AAA). They have maturities across a wide spectrum, having been out more than 30 years in some cases.

Two further categories are government agencies and local authorities, such as the Export Import Bank of Korea and the province of British Columbia in Canada. Last, it includes some sovereign issues by governments borrowing in a currency other than their own, with examples such as dollar bonds issued by Mexico, or euro issues from Poland, or Italy borrowing in sterling.

Yield levels create an appealing draw for inflows to the asset class

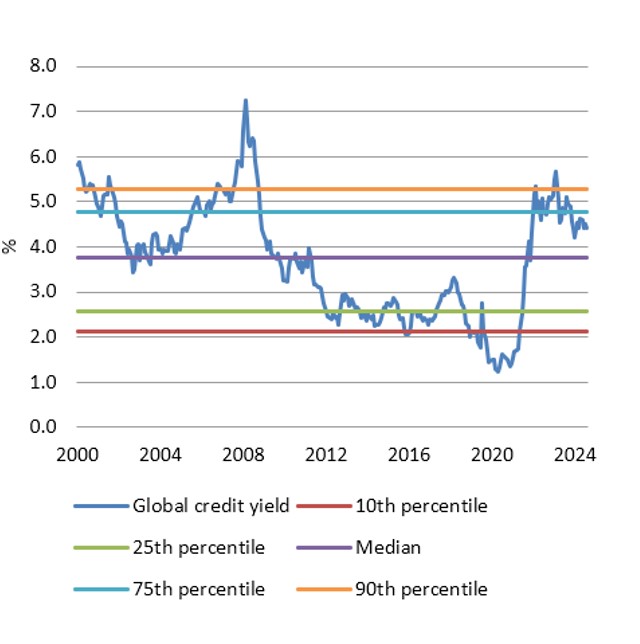

The level of yield available in the global credit market has varied greatly over the last 25 years (see Figure 1). Today, they are at attractive levels relative to the last 15 years or so.

Figure 1: Yields on global credit at attractive levels (1)

In the 2000s, prior to the global financial crisis, the average yield on of the Index ranged between approximately 4 per cent and 6 per cent. (2) During that period credit spreads over government bond yields tightened to the narrowest they had been. Spreads remained tight for most of the period from 2004 to 2007, with the increase in the overall yield during that time stemming primarily from higher government bond yields.

The global financial crisis in 2008 to 2009 created a sharp spike higher in spreads, which took investment grade credit yields to new highs, briefly exceeding 7 per cent, despite underlying government bond yields falling at the time. The ensuing economic decline and the extensive economic and market support measures that governments and central banks implemented, brought about a rapid decline in spreads and with that, yields. Though spread levels remained volatile for much of the next decade, yields trended lower and lower. Yields fell below 2 per cent just prior to the Covid-19 pandemic, which may have brought the attractions of global credit into question, but even then, spread levels did not appear uncomfortably tight as the alternative, yields on government bonds and cash deposits were close to or in some cases, below zero.

Yield levels on credit rose sharply in 2021 and 2022 as inflation took hold and as central banks sought to combat rising prices by rapidly increasing official interest rates. In a short space of time, credit yields rose above 5 per cent for the first time in more than a decade.

Spread levels have also risen in recent months, pushed higher by an increase in economic uncertainty to a point that is much closer to what we see is fair value.

Current attractions of global credit: protection and potential

Higher yields and spreads appeal in two important ways. First, higher yield levels can provide some form of protection, with higher ongoing income insulating investors who may be concerned about the possibility for future capital losses. Second, the higher yields are, the greater is the potential for them to decline and generate capital gains.

Markets are in a position where lower yields could come from two sources: either underlying government bond yields could decline, as may occur if inflation concerns continue to ease; or credit spreads could tighten, which may result if economic concerns dissipate.

Only recently, investors would likely have had to take on greater risk in high yield markets to have been able to achieve the levels of yield that investment grade markets currently offer. They have seen that as an attractive opportunity. Now that investment grade markets offer attractive yields alongside lower risk, we believe that global credit will be attractive for many investors.

Footnotes

1, Source: Insight and Bloomberg. As at 30 April 2025. Bloomberg Global Agg Credit Index yield to worst.

2, Source for all yield data: Insight and Bloomberg. As at 30 April 2025

Disclaimer

Investment managers are appointed by BNY Mellon Investment Management EMEA Limited (BNYMIM EMEA), BNY Mellon Fund Management (Luxembourg) S.A. (BNY MFML) or affiliated fund operating companies to undertake portfolio management activities in relation to contracts for products and services entered into by clients with BNYMIM EMEA, BNY MFML or the BNY Mellon funds.

The value of investments can fall. Investors may not get back the amount invested. Income from investments may vary and is not guaranteed.

Important information

For professional clients only. This is a financial promotion. Any views and opinions are those of the investment manager, unless otherwise noted. This is not investment research or a research recommendation for regulatory purposes.