The following article, part of a series of expert views being shared by authors with this publication, examines the reputational risks arising from tax. The author is Matthew Gilleard, who is a senior media strategist at communications consultancy and a former tax journalist. The editors are pleased to share these views and invite readers to respond. The usual editorial disclaimers apply. Email tom.burroughes@wealthbriefing.com

Taxation. Everybody understands the need for it, to a greater or lesser extent. It is a fact of life – the “price we pay for living in a civilised society.” But nobody truly relishes paying it. Which makes it all the more distasteful if others are shown not to be.

For the general public, it’s an example of the age-old media classic: an “us and them” story. There is a certain whiff of voyeurism to it all. Your own tax affairs? Boring, prosaic. But the financial affairs of others? Intriguing. Add in some big numbers or a high-profile name and interest suddenly ramps up.

A national stereotype is that Brits love to see people brought down a peg or two. In the US, for example, wealth and success seems to be far more widely and openly celebrated. Here, the underdog gets the loudest cheer…as long as they don’t grow too big and successful. It is at the top of the pyramid that the sun shines brightest, and one false step can bring you swiftly back down to earth.

Without getting into socio-philosophical debates around ‘aspirational versus jealous attitudes to wealth’, it is worth noting one major trend. When the economy is in downturn, financial affairs become more important. Interest and scrutiny of taxation therefore peaks. Tolerance for perceived abuse or injustice falls, while outrage and backlashes rise.

All of which makes tax a reputational risk factor that cannot be ignored.

In the arena of taxation, what constitutes ‘abuse’ is tricky. Matters of law (tax or otherwise) should be black and white, but that is not always the case. Complexity is a great divider. It allows misunderstanding to drive a wedge between reality and perception. For HNW individuals, therefore, this potential gap must be minimised – primarily through a clear approach and, when required, clear communication of that approach.

Concepts of “tax morality” or “tax fairness” are nebulous and ill-defined, but the court of public opinion is powerful and leaves little room for appeals.

Timing is everything. Infinite Global research shows that now is a time of heightened reputational risk, as economic downturn, high inflation, soaring energy prices and a cost-of-living crisis combine to thrust tax avoidance into the limelight.

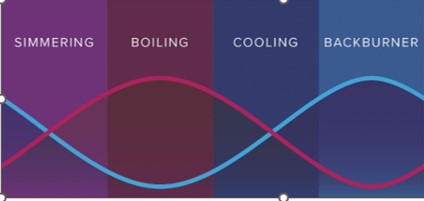

As you can see from the graphic below, our analysis reveals that:

• media and stakeholder interest in taxation fluctuates with inverse correlation to the economic health of a nation; and

• there are four phases of scrutiny.

HNW individuals are advised to monitor the evolution of these four phases, tailoring their tax (and communication) strategies accordingly. Failure to do so leads to heightened reputational risk.

Our model shows a cyclical pattern. When the UK economy last took a major nosedive, scrutiny was aimed initially on the big tech companies with seemingly low tax bills. The focus also fell on HNW individuals, particularly those in the public eye. Since then, economic recovery dimmed the spotlight, though events like the Panama and Paradise Papers showed that one incendiary spark can turn up the heat once more.

For high-profile and wealthy individuals, complacency must be avoided at all times. A proactive approach to tax reputation management means that you are not left scrambling to explain, adjust and correct a situation if and when an incendiary spark does ignite interest.

The most recent sign of scrutiny having returned was a particularly interesting tale, as it involved a member of parliament who was previously the UK Chancellor, no less. A big name, check. Big sums, check. Potential injustice and conflict of interest, check. As any media professional will tell you, that spells ‘story’.

Of course, that story has implications beyond the financial conduct of Nadhim Zahawi alone, sounding a cautionary note for any HNW individuals believing that their own tax approach is a purely personal affair. While it is true to an extent that financial privacy and confidentiality applies, disclosure requirements mean that certain information can be published, publicised and interrogated. HNW individuals must be prepared for that information to be accompanied by clear communication of the underlying strategy, if required.

Central, therefore, to balancing the competing concerns of privacy and accountability is communication. A clear position and a clear explanation of that position is the best defence against stakeholder scrutiny.

Risk factors change over time. This makes them difficult to manage, and important to monitor. What is going on in the wider world matters, and must also be monitored. But, with the right approach and the right communications tactics, the balance between protection of financial privacy and transparency of reporting obligations can be maintained.