The UK's has now published its near final rules for the single remuneration code for MIFID investment firms.

The new code will replace the existing BIPRU and IFPRU Remuneration Codes and will be known as the MIFIDPRU Remuneration Code (“MIFIDPRU”). MIFIDPRU will apply to performance periods beginning on or after 1 January 2022 and will require many firms to implement changes to their reward policies and practices. A copy of the FCA Policy Statement (PS21/9) containing the near final rules can be found here.

Background

MIFIDPRU is based on (but differs in some respects from) the remuneration rules set out in the EU Investment Firms Regulation ((EU) 2019/2033) (IFR) and the Investment Firms Directive ((EU) 2019/2034) (IFD). The FCA’s stated objectives are to:

-- promote effective risk management in the long-term interests of the firm and its customers;

-- ensure alignment between risk and individual reward;

-- support positive behaviours and healthy firm cultures; and

-- discourage behaviours that can lead to misconduct and poor customer outcomes.

MIFIDPRU will apply to performance periods beginning on or after 1 January 2022. Importantly the focus is on the ‘performance period’ rather than the date on which remuneration is awarded or paid out.

This means that firms currently subject to the existing IFPRU and/or BIPRU Remuneration Codes should continue to apply those rules in respect of remuneration paid in 2022 which relates to performance or services provided during a period which started before 1 January 2022.

Overview of the MIFIDPRU Remuneration Code

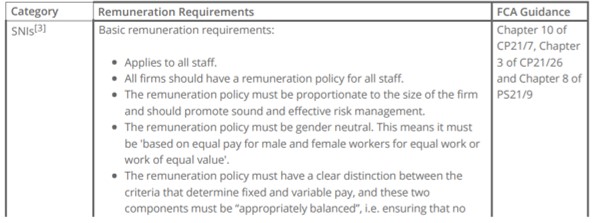

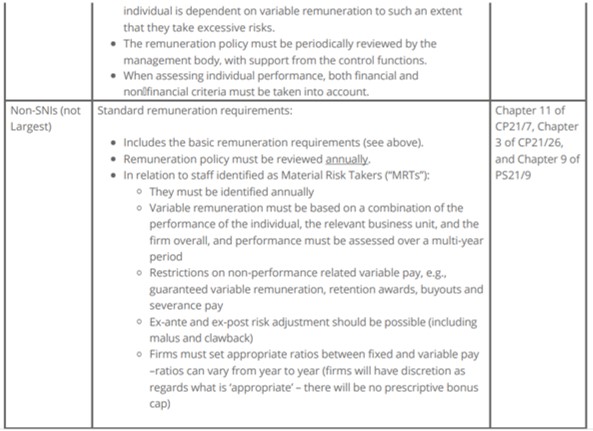

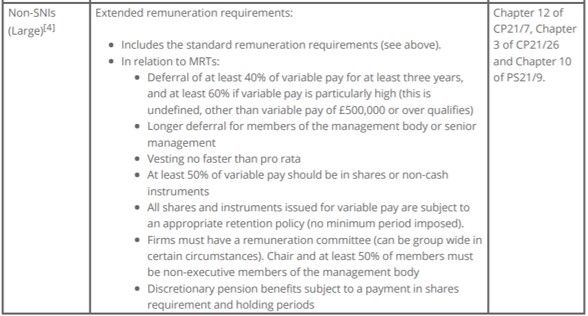

The extent to which the MIFIDPRU Remuneration Code applies to a firm depends on how it is categorised under the new Investment Firm Prudential Regime (IFPR). Broadly speaking, this categorisation is based on a number of financial thresholds, the details of which can be found in the FCA’s IFPR publications. There are three categories:

-- Smaller and non-interconnected firms (SNIs);

-- Non-SNIs; and

-- Largest non-SNIs.

We have summarised the main requirements in the table below (the disclosure requirements are covered separately below).

Further Analysis

Gender-neutral

Some respondents to an earlier IFPR discussion paper queried why the remuneration policy should be gender-neutral, since that is already a requirement of the equal pay legislation. However, the FCA wanted to include it to “support and reaffirm our aim to drive healthy purposeful cultures in firms, which includes developing an inclusive and diverse workplace."

the key characteristics of their remuneration policies and practices; certain quantitative disclosures about the remuneration outcomes of their staff; the types of staff they have identified as MRTs (non-SNI firms only).

In line with its approach to proportionality under the MIFIDPRU Remuneration Code, a firm must disclose information in line with its category under the MIFIDPRU Remuneration Code (see above). Larger firms are expected to disclose more detail. Disclosures need to be easily accessible and understandable by stakeholders, so firms will need to publish their disclosures in an easily-found part of their website and use easily-understood language and diagrams, where relevant. Firms must publish their disclosures annually, alongside their annual financial statements (or annual solvency statement). Disclosures should be made more frequently if a firm undergoes a significant change, e.g. a merger or acquisition.

Material risk takers

MRTs are to be identified based on certain criteria. The FCA said: “The aim is to identify all those individuals whose professional activities can have a material impact on the risk profile of the firm or the assets it manages. In conducting this exercise, an FCA investment firm should consider all types of risks involved in its professional activities. These may include prudential, operational, market, conduct and reputational risks.”

There is no requirement to identify MRTs based on remuneration alone, as this is not a reliable indicator of the level of risk involved in a particular role within a firm. Instead, the assessment will be made based on qualitative criteria.

For large non-SNI firms to which the extended remuneration requirements apply, MRTs are exempt from those rules if (i) they receive variable remuneration of £167,000 or less, and (ii) that variable remuneration makes up one third or less of their total remuneration. Both criteria must be met for the exemption to apply. However, note that this exemption only applies with respect to the extended remuneration requirements and the basic and standard remuneration requirements will still apply to those MRTs.

Malus and clawback

Firms must determine their own triggers for applying malus or clawback. However, the FCA has said that malus should be applied where i) there is reasonable evidence of employee misbehaviour or material error, ii) the firm or the relevant business unit suffers a material downturn in its financial performance, or iii) the firm or the relevant business unit suffers a material failure of risk management, and clawback should always be applied in cases of fraud or other conduct with intent or severe negligence which led to significant losses. For large non-SNIs, their remuneration policies must include the possibility of applying in-year adjustments, malus and clawback. Guaranteed variable remuneration (also referred to as a “sign-on bonus” or “golden handshake”) should only be awarded to MRTs rarely and not as common practice, in the context of hiring a new MRT, in the first year of service and where the firm has a strong capital base. Retention awards are permitted but should be used only rarely (e.g. in the context of specific projects) and should be awarded only after the retention period has ended.

Buy-out awards involve a firm compensating a new employee whose deferred variable remuneration was reduced by their previous employer. Non-SNIs must ensure that the buy-out is aligned with the long-term interests of their firm and remains subject to the same pay-out terms required by the previous employer, e.g. by following the same deferral and vesting schedule. Non-SNIs should set out any criteria for determining severance pay in their remuneration policy and all severance payments must reflect the individual’s performance over time and must not reward failure or misconduct.

Discretionary pensions benefits

For the purposes of the application of remuneration rules, discretionary pension benefits are treated as a form of variable remuneration. Under the new rules, all non-SNIs will be required to ensure that all discretionary pension benefits are in line with the business strategy, objectives, values and long-term interests of the firm; award the full amount in shares, instruments or within any alternative arrangements the FCA has approved; and apply malus and clawback to discretionary pension benefits in the same way as to other elements of variable remuneration.

The FCA said they would not usually consider returns made by staff on co-investment arrangements to be remuneration for the purposes of its rules, but they would usually consider carried interest to be remuneration.

Next steps

These are the steps firms should be thinking about ahead of 1 January 2022:

-- Assess which category of firm applies based on the financial thresholds (e.g. SNI);

-- Consider whether remuneration policies and practices should be reviewed and amended;

-- Non-SNIs will need to determine which individuals are MRTs (which is likely to be wider than those carrying out;

-- senior management functions) and carry out a review of those individuals’ remuneration.

-- Large non-SNIs will need to consider whether they meet the requirements with respect to remuneration committees.

-- Careful analysis will be needed by firms that are part of groups, including looking at applicable group consolidation rules;

-- Multinational firms subject to MIFIDPRU Remuneration Code as well as IFD and IFR remuneration rules in other jurisdictions will need to consider issues such as the interaction of the regimes and the extent to which employees outside the UK might be caught by MIFIDPRU;

-- Firms will need to come to terms with the new disclosure requirements and assess what needs to be disclosed and when.

This article was first published in Thomson Reuters on Thursday 19 August 2021

Footnotes

A firm falls into this category if its i) on- and off-balance sheet assets over a 4-year period have a rolling average of more than £300m or ii) over the same period its on- and off-balance sheet assets have a rolling average of more than £100m, and it has a trading book business of over £150m, and/or derivatives business of over £100m. For further details of these thresholds and how they should be applied by firms, see para 9.22 of CP21/7 and section 7 of PS21/9.

Para 3.53 – 3.69 of CP21/26 (see Tables 3 and 4).

Para 8.15 of PS21/9.