Nearly half of wealthy investors are ready to invest up to 15 per cent of their funds into sustainable investments over the next three years, but they are still facing a looming advice gap, according to a new survey of investors from 's data last month confirmed that ESG has been out-performing conventional funds, before and during the crisis, suggesting that any trade-off doubts are fading.

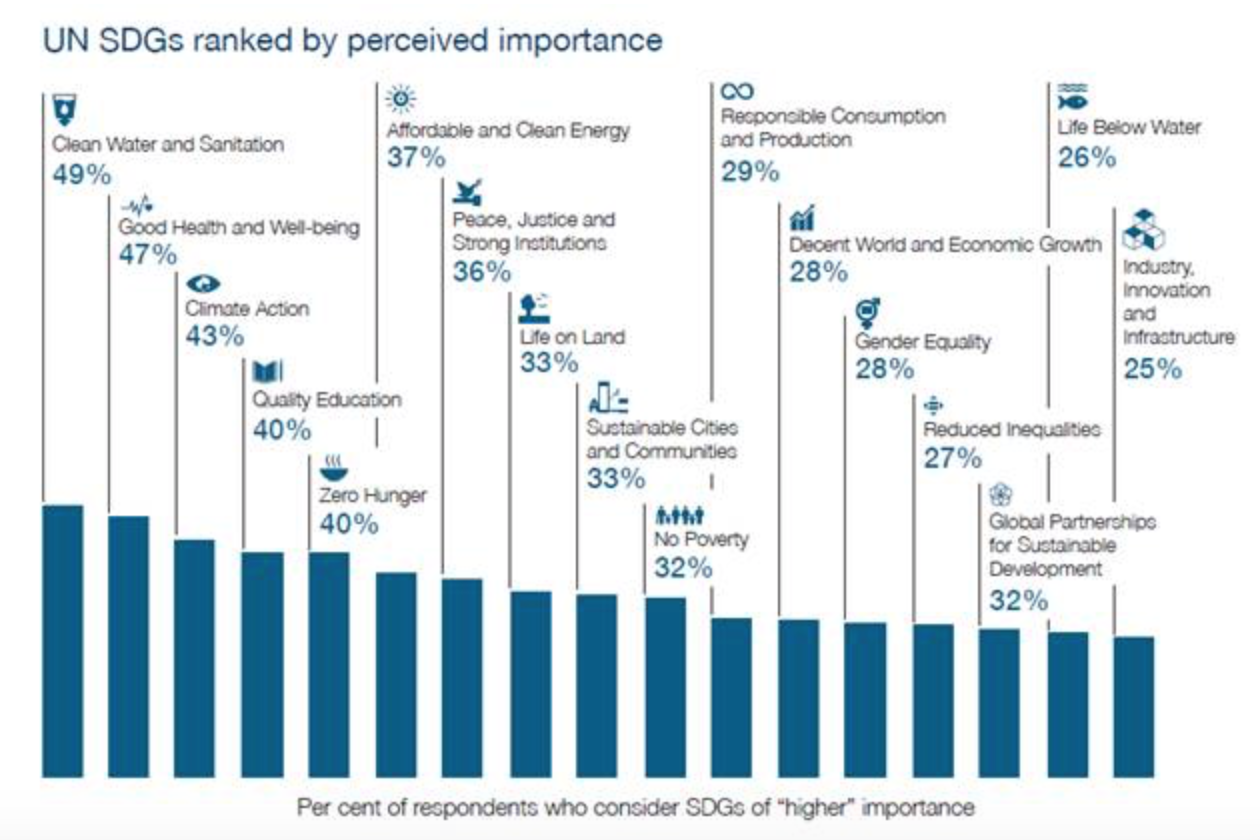

On the themes investors most care about, this year's participants put clean water/sanitation and health/wellbeing as the most important themes in the UN’s Sustainable Developed Goals. The 17 SDGs have been a staple for green finance in developing thematic solutions for clients. Climate action was their next priority, followed by good quality education and zero hunger. How investors ranked different themes is shown in the graphic below.

UK clients were the most likely to have previously invested in SRI (83 per cent) and were more familiar with the SDGs than the other three markets. UK investors, as in last year, were most behind investing in affordable clean energy.

The UAE were the largest group of affluent investors surveyed and the most apprehensive about SRI. They also had the most request for knowledge about ESG investment terminology. UAE investors, for example, were the least familiar with low-carbon investing. Perhaps understandable given the region's reliance on oil wealth, but valid in the context that several oil giants have writen off billions in stranded assets the last few months.

Investor types

Research showed investors falling broadly into five categories: optimisers, impact believers, cautious, resistant and apathetic. How those groups break down is shown in the chart below. The global bank has been putting greater emphasis on using personality data to tailor approaches.

"Knowing how clients’ investor personalities influence their investment approach allows us to help unlock any barriers. This is where our impact philosophy is useful in giving clients a structured framework to identify environmental and social causes that matter to them, as well as to understand the risks and returns of potential opportunities,” von Daeniken said.

Also noteworthy: Singapore investors rated clean water/sanitation highest, while investors in Hong Kong put climate action on top. Singapore’s wealthy are also more apprehensive about sustainable investing (45 per cent) than their Hong Kong neighbours (30 per cent). The greatest interest in sustainable investing in the UAE came from the young and educated in the region.