Environmental, social and governance-themed investments were hit less severely than the overall financial market by the COVID-19 pandemic, based on data provided by . The organisation crunched numbers from more than 2,600 companies.

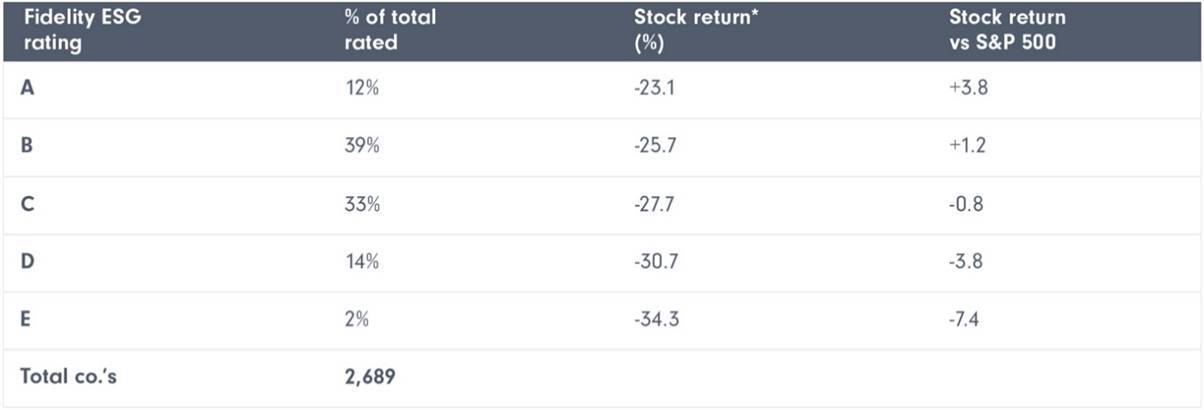

Each additional level (from A to E) of Fidelity’s proprietary ESG ratings was worth 2.8 percentage points of stock performance versus the index during recent volatility, the firm said in a statement late last week.

Source: Fidelity International

Such figures fuel debate over whether ESG investing is sufficiently robust as a method to withstand market shocks of the sort highlighted by the virus. Argument continues over whether screening firms out – such as those producing carbon dioxide emissions – hurts returns or improves them beyond what would otherwise be the case. (This firm is looking at ESG investment across a variety of fronts; see this overview.)

Fidelity International said the data it tracked showed that a company’s market performance and ESG rating are positively correlated, even in a crisis. The equity and fixed income securities issued by companies at the top of Fidelity’s sustainability rating scale (A and B) on average outperformed those with average (C) and weaker ratings (D and E) in this short period.

In the 36 days between 19 Feb and 26 March, the S&P 500 fell by 26.9 per cent. Meanwhile, the price of a share in companies with a high (A or B) Fidelity ESG rating dropped less than that on average, while those rated C to E fell more than the benchmark. A-rated companies performed on average 3.8 percentage points better, while E-rated companies performed on average 7.4 percentage points worse than the S&P 500 during the period examined.

“No asset was spared as the severity of the economic shutdown needed to contain the coronavirus outbreak became apparent to investors. The quickest US bear market in history, from February to March this year, was also the first broad-based market crash of the sustainable investing era,” Jenn-Hui Tan, global head of stewardship and sustainable investing, Fidelity International, said. “Our thesis, when starting the research, was that the companies with good sustainability characteristics have better management teams and so should outperform the market, even in a crisis. The data that came back supported this view.”

The bonds of the 149 A-rated companies returned -9.23 per cent on average, compared with -13.16 per cent for B-rated companies and -17.14 per cent for C-rated companies, Fidelity said.