Some private equity valuations are “incredibly inflated” and the asset class is not immune to shifts in the economic cycle, but structurally the sector is here to stay and an important destination, attendees at an investment forum heard.

“There will be a cyclical, not structural, adjustment,” Jean Eric Salata, chief executive, founding partner at , told this news service that private equity was highly cyclical as an asset class with, in his view, few diversification benefits at present.

Private equity has drawn in investments over recent years because it pays higher returns than for conventional listed equities – but the drawback is far lower liquidity. Private equity investments are typically held in for about five years or so. There has been some improvement as a secondary private equity market has developed. According to figures quoted at the Wharton forum, the assets of “secondaries” now stand at around $180 billion globally.

The median private equity deal was 12.9 times a measure of company earnings, beating the previous record of 10 times earnings in 2006, according to Murray Devine Valuation Advisors, a firm based in Philadelphia, last year (source: Institutional Investor, April 2018).

It appears that those involved in the asset class aren’t getting unduly worried: .

Benefits of being locked up

Salata said there are some benefits to the lock-ups involved with private equity – an investor has some freedom to wait in a falling market to buy assets at cheap valuations and profit from subsequent gains. “That is what appeals to people about the asset class,” he said.

Private equity is often measured by the “vintage” of a fund (like wine, the starting point is from when the fruit is picked) and practitioners suggest investors hold a blend of vintages so that funds coming towards the end of their “normal” investment life sit alongside younger ones.

A figure mentioned by panellists was how there are $500 billion or more of private equity investments in funds created before 2008 – the year of the financial crisis.

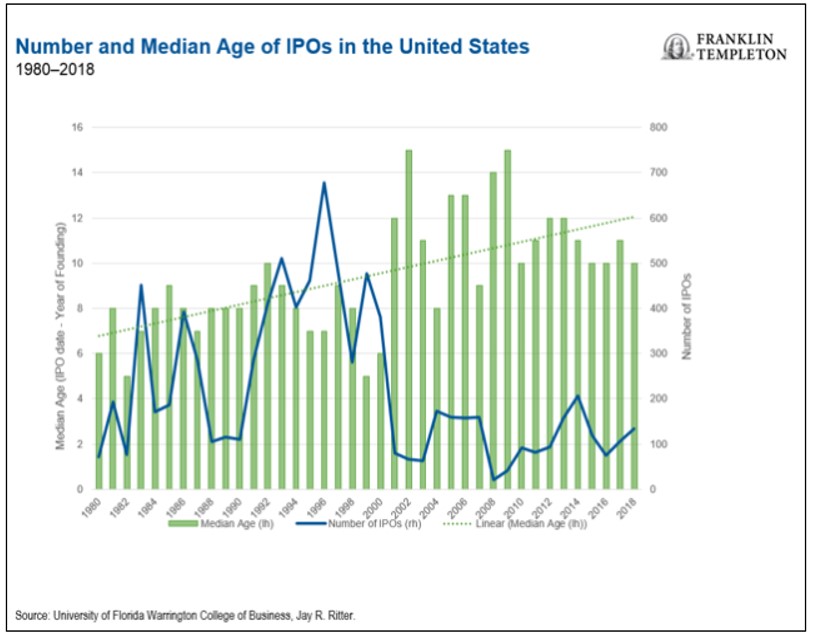

Permira’s Bjorkland argued that evidence suggests privately-held firms (rather than those listed on public markets) tend to be more robust financially and that a lot of young entrepreneurs today don’t think the ideal end-point is an initial public offering, as might have been the case more than a decade ago. Data suggests that firms are staying “private for longer” than was the case, say, during the 1990s dotcom boom. On the other hand, the development of a secondaries PE market suggests that investors seek exits if the older route of selling shares becomes less available.