The global real estate market is at a risk of a bubble or a significant overvaluation of housing markets in most major developed market financial centers, a new report by UBS says.

The UBS Global Real Estate Bubble Index 2018 from 's chief investment office looks at the prices of real estate in the biggest cities around the world.

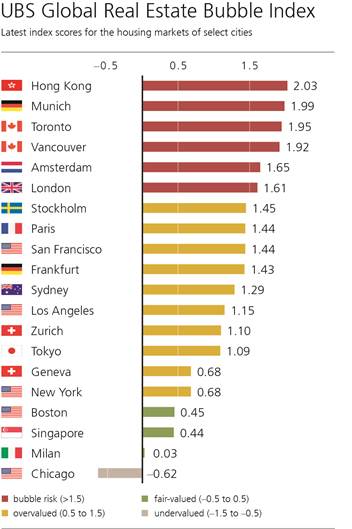

Bubble risk appears greatest in Hong Kong, followed by Munich, Toronto, Vancouver, London and Amsterdam. Major imbalances also characterize Stockholm, Paris, San Francisco, Frankfurt and Sydney. Valuations are stretched in Los Angeles, Zurich, Tokyo, Geneva and New York.

By contrast, property markets in Boston, Singapore and Milan seem fairly valued while Chicago is undervalued. Bubble risk soared in Munich, Amsterdam and Hong Kong over the last year. In Vancouver, San Francisco and Frankfurt, too, imbalances continued to grow, the report said.

More broadly, index scores fell in no less than one-third of the cities. Stockholm and Sydney experienced the steepest drop and moved out of bubble risk territory. Valuations went down slightly in London, New York, Milan, Toronto and Geneva.

In contrast to the boom of the mid-2000s, however, no global evidence of simultaneous excesses in lending and construction exists. Outstanding mortgage volumes are growing half as fast as in the run-up to the financial crisis, limiting economic damage from any price correction.

In the past year, the house price boom in key cities lost intensity and scope. Inflation-adjusted city prices increased by 3.5 per cent on average over the last four quarters, considerably less than in previous years but still above the 10-year average.

They remained on an uptrend in the largest eurozone economic centers, as well as in Hong Kong or Vancouver. But the first cracks in the boom’s foundation have begun appearing: house prices declined in half of last year’s bubble risk cities - in London, Stockholm and Sydney - by more than 5 per cent in real terms.

"The median total return on housing in the most important developed market financial centers was 10 per cent annually over the past five years, accounting for an imputed rental income and book profits from rising prices," said Claudio Saputelli, head of real estate at UBS Global Wealth Management's chief investment office. "How appealing returns will be in the next few years is questionable. We recommend caution when buying residential real estate in most of the biggest developed market cities."

The report comes at a day after the US Federal Reserve, responding to an increasingly strong domestic economy, hiked rates for the third time this year. The federal funds rate rose a quarter percentage point to a range of 2 per cent to 2.25 per cent.

Source: UBS