The UK’s taxman is collecting more inheritance tax (IHT) as people increasingly attempt to handle complex litigation themselves, resulting in less relief being handed out, a law firm has said.

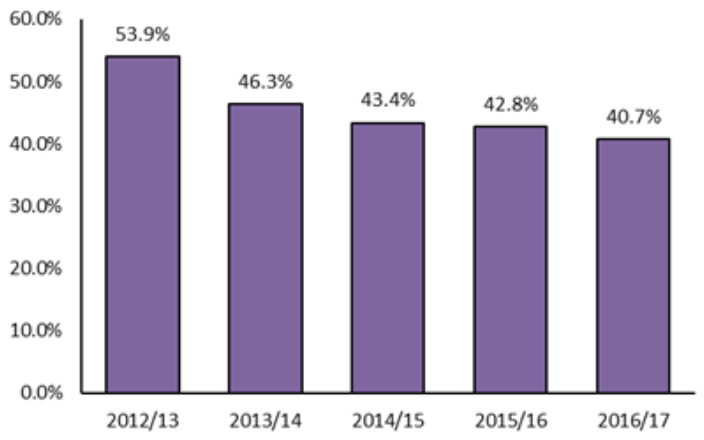

A rising “do-it-yourself” approach to probates, the judicial process of dealing with the estate of a deceased person, means IHT tax reliefs claimed now account for 41 per cent of the total IHT paid to HMRC, falling from 54 per cent in 2012/13, according to , the UK-based private client law firm.

The value of IHT receipts was £4.8 billion ($6.9 billion) in 2016/17, Wilsons said, up 55 per cent from £3.1 billion in 2012/13. Meanwhile, although there was an increase in the value of IHT reliefs paid out on estates, it trailed far behind, rising just 18 per cent to £2 billion.

“Executors who ‘DIY’ probate often think they are saving on legal costs, but, in fact, many end up being taxed more,” Alison Morris, partner at Wilsons, said. “Now that it is possible to apply for probate online, more individuals are applying without fully understanding the complex procedures around executing wills. As a result, the layman could find that they miss out on IHT reliefs, if they do not consult a solicitor.”

Proportion of estates eligible for IHT reliefs who claimed them dropped to 41 per cent last year. Source: Wilsons

In addition, non-professional executors could risk legal action being taken against them if beneficiaries lost out on IHT reliefs, Morris explained.

“If non-professional executors make mistakes when applying for probate, they could overlook some or all of the IHT reliefs available, increasing the likelihood of disputes over wills in court,” Wilsons said in a statement accompanying the data.