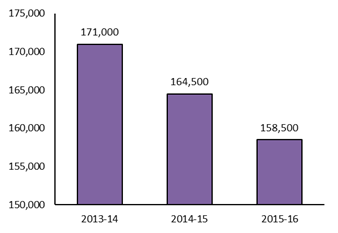

The number of overall trusts in the UK fell 4 per cent from 164,500 in 2014/15 to 158,500 in 2015/16, according to the latest statistics from , the nation's taxman.

This comes as the UK government continues to crackdown on tax evasion, as it looks to delve into all the layers surrounding the trust industry.

There are a number of reasons for setting up trusts, including:

• To control and protect family assets

• To pass on money or property while the settlor is still alive

• To pass on money or assets when the settlor dies, under the terms of their will

• When someone is too young to handle their affairs

• When someone cannot handle their affairs because they are incapacitated

Recently, in line with the current transparency agenda in the financial sector, and in compliance with European Union regulations, HMRC introduced a new trusts register which records all UK and non-UK trusts that have a UK tax liability. The register captures information on all relevant parties to a trust, including the settlor and beneficiaries (whether actual or potential) as well as certain advisors to the trust. The register is not public.

As it introduces tax changes and new regulatory requirements designed to tackle tax evasion and money laundering, the government has been making trusts look rather undesirable to individuals. Also it has made legitimate tax schemes seem illegal and made innocent individuals look as if they are committing a crime.

James Badcock, partner at law firm , said: “The government is continuing its war on trusts, and many everyday users of trusts have been collateral damage in this. Taxpayers trying to undertake legitimate and prudent estate planning are becoming victims of punitive tax changes and time-consuming new regulatory requirements.”

He added: “Trusts have been out of the Government’s favour since at least 2006. Trusts are a standard part of estate planning for a huge number of “middle England” families, and heavy restriction has made this much more difficult. If used correctly, trusts can be very beneficial for estate planning – particularly for life policies, or for entrepreneurs for passing down or selling their family business.”

Graph 1: The decline in the number of UK trusts

Source: Collyer Bristow